Karora Resources Inc. (TSX:KRR; OTCQX:KRRGF) ("Karora" or the “Corporation" – https://www.commodity-tv.com/ondemand/companies/profil/karora-resources-inc/) is pleased to announce its financial results and review of activities for the three and six months ended June 30, 2022. All amounts are expressed in Canadian dollars, unless otherwise noted. For additional information please refer to Karora’s Management’s Discussion & Analysis ("MD&A") and unaudited condensed interim consolidated financial statements for the three and six months ended June 30, 2022 and 2021.

Karora is also pleased to announce the results of its PEA study on Nickel mining at Beta Hunt resulting in a 105% IRR using base case (US$19,500/t Ni) assumptions and 232% IRR at upside case assumptions (US$25,000/t: current consensus Ni pricing). The PEA demonstrates the tremendous by-product potential of Karora’s initial nickel resource (see Karora news release dated May 11, 2022) at Beta Hunt. Karora continues to aggressively drill test the potential expansion of the nickel resource which has significant potential to expand in years to come. Importantly, the nickel PEA demonstrates ability to leverage the dual-purpose infrastructure in place at Beta Hunt – a unique feature of the mine which materially reduces capital requirements. The strong results of the study are briefly summarized below however readers are encouraged to read Karora’s nickel PEA news release announced this morning and available on our website, www.karoraresources.com, and on Sedar.

Highlights

• Second quarter 2022 consolidated gold production of 30,652 ounces was the highest total since the acquisition of the Higginsville Mill in 2019 and a 12% improvement compared to 27,489 ounces produced in the first quarter. First half production of 58,141 ounces places Karora well on track to deliver on improved full year consolidated 2022 gold production guidance of 120,000 to 135,000 ounces (assumes no significant interruption to operations as a result of the COVID-19 virus in the second half of 2022).

• Record tonnage performance at Beta Hunt with 290,000 tonnes mined during the second quarter. Tonnes mined through the single decline have been steadily increasing as productivity and operational performance improve in advance of the commissioning of the second decline in the first quarter of 2023, despite challenges with COVID related interruptions and tight labour market conditions. Second quarter 2022 consolidated all-in-sustaining-costs (“AISC”)1 of US$1,190 per ounce sold is a 15% decrease compared to first quarter 2022 AISC of US$1,396 per ounce sold.

• Net loss of $0.3 million, or $0.00 per share, for the second quarter of 2022 was down $5.7 million compared to second quarter 2021 net earnings of $5.4 million, or $0.04 per share.

• Adjusted earnings1 of $4.7 million, or $0.03 per share for the second quarter of 2022, down $9.6 million compared to second quarter 2021 adjusted net earnings of $14.3 million, or $0.10 per share.

• Adjusted EBITDA1 was $22.6 million or $0.14 per share for the second quarter of 2022, down $6.9 million from $29.5 million in the second quarter of 2021, largely due to higher production costs (including transitory costs related to COVID) and non-cash adjustments related to share-based payments, derivatives and foreign exchange related to intercompany loans.

• Cash flow from operating activities of $11.2 million decreased compared to $26.3 million for the second quarter of 2021 primarily related to higher production costs largely impacted by the aforementioned cost pressures.

• Karora’s cash position remains strong at $114.1 million as at June 30, 2022, after the planned deployment of capital into the Company’s growth plan at Beta Hunt and the acceleration of exploration programs.

• On June 14, 2022, Karora closed a bought deal financing of 14,375,000 common shares at a price of $4.80 per common share despite very challenging equity market conditions, for gross proceeds to the Company of $69,000,000, including the exercise in full of the Underwriters‘ over-allotment option.

• During the second quarter Karora entered into a binding agreement to acquire the 1.0 Mtpa Lakewood Mill operating gold processing facility located near Kalgoorlie Western Australia for A$80 million comprised of A$70 million in cash and A$10 million in Karora shares. The transaction closed on July 27, 2022. Tolling of Beta Hunt material at Lakewood Mill during Q2 2022 achieved 94% gold recovery. The purchase of the Lakewood mill increases tolling capacity of the group to approximately 2.6Mtpa, significantly de-risking growth plans to increase gold production to between 185,000 and 205,000 ounces by 2024 given the current significant cost pressures experienced in new capital projects across the industry.

• Beta Hunt’s second decline, commenced in the first quarter of 2022 with the second (west) decline boxcut now completed. The access portal cut and decline development commenced from the surface during the quarter. Contract development has advanced 1,032m since commencing in December 2021, ahead of schedule despite COVID impacts on contractor crews. Surface raise bore civil works associated with increased ventilation demands of the future 2.0 Mtpa mining rate have also commenced. The Company remains on track to complete the decline in the first quarter of 2023.

• On July 14, 2022, Karora closed an arrangement to refinance its Bridge Loan with a lower-cost senior secured $80 million Credit Agreement with Macquarie Bank Limited ("Macquarie"). The Credit Agreement provides for a $40 Million term loan and a $40 million revolving credit facility, both bearing an interest rate of Canadian Dealer Offered Rate +4.5% per annum on the drawn principal and standby fee of 1.5% per annum on the undrawn revolving credit facility. The term of the Credit Agreement is to June 28, 2024 with an option for annual renewal thereafter. The proceeds of the Credit Agreement were used to refinance Karora’s existing $30 million Bridge facility and will be used for general working capital purposes.

• On July 15, 2022, Karora received approval of the TSX for a normal course issuer bid (the "Bid") to purchase up to no more than 8,492,971 of the Corporation’s issued and outstanding common shares. Purchases under the Bid may commence on July 20, 2022. The Bid will expire no later than July 19, 2023. Purchases of common shares will be made through the facilities of the TSX in accordance with its rules. Purchases may also be made through alternative Canadian trading systems. The Corporation has not made any purchases of its common shares during the past twelve months.

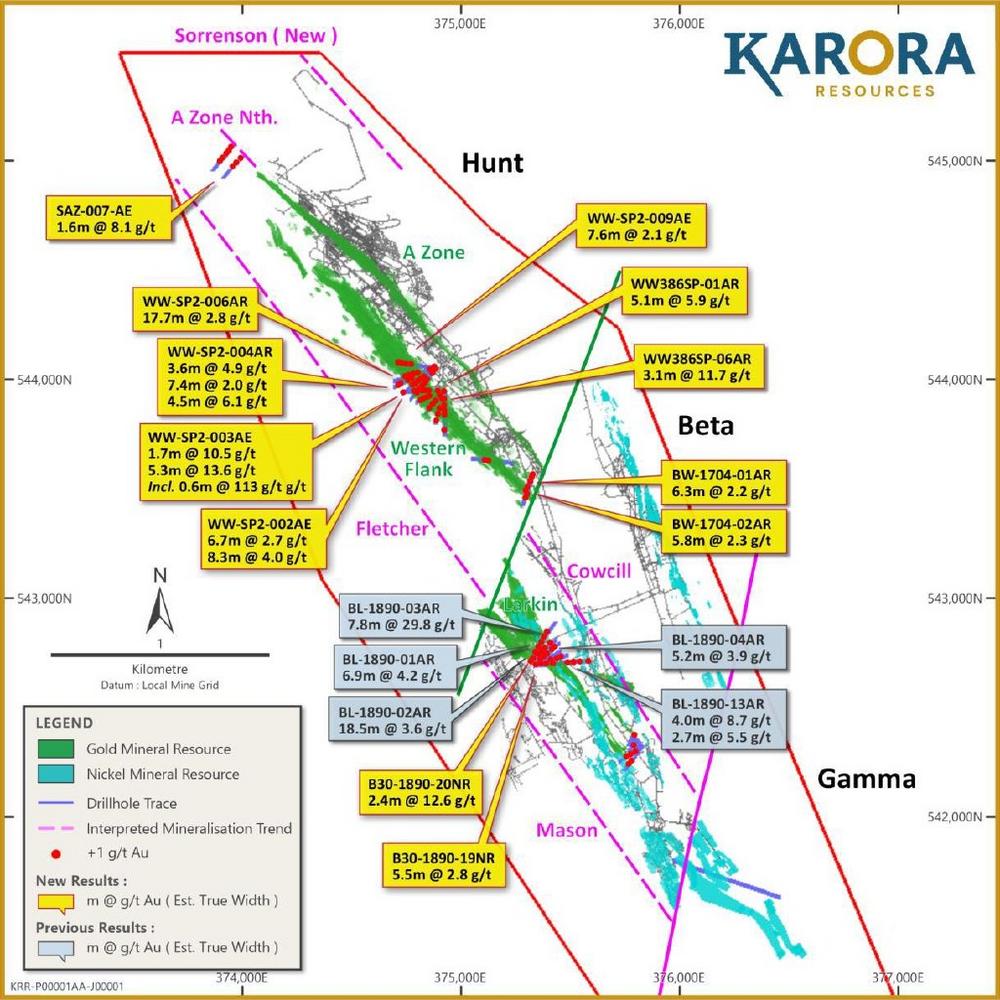

• Drilling at Beta Hunt’s Western Flanks zone confirm the consistency of the Western Flanks Main shear mineralization up to 150 metres below the current Mineral Resource, including an interval of 13.6 g/t over 5.3 metres (see Karora news release dated August 2, 2022). The Western Flanks is Beta Hunt’s largest gold zone and these results provide increased confidence for the continued expansion of Karora’s resource base. In addition to extending the Main Shear mineralization, drilling has also outlined significant footwall mineralization which is not included in the current Mineral Resource.

• Positive Preliminary Economic Assessment (“PEA”) for increased nickel production from the Beta Hunt Mine. Highlights from the PEA include:

• Strong Economics on Initial Resource: Base case results (nickel price of US$19,500/t) yields a pre-tax NPV5% of A$57 million and IRR of 105%. Upside case results, closer to nickel consensus pricing of US$25,000/t yields a pre-tax A$111 million NPV5% and IRR of 232%.

• Leverage to Nickel Prices: A 20% increase in the nickel price increases NPV5% to A$95.2 million, or 66% compared to the Base Case.

• Low-Cost: Nickel net C1 cash costs are expected to be A$14,542/t. Base Case Net AISC costs are expected to be A$16,946/t. On a per gold ounce produced basis, this equates to an approximate annual average of A$80 to A$100 per ounce sold.

• Upside Potential: The Beta Hunt Nickel Mineral Resource occurs in two main blocks, the Beta Block and Gamma Block, both of which have significant potential for Mineral Resource additions, including the 50C nickel trend where continuous nickel mineralization has been defined over 800 metres in strike, with the potential to extend up to 2.6 km in strike length. The current PEA results are based on only the current Beta Hunt Nickel resource, with significant expansion potential remaining.

• Nickel drilling: Nickel-dedicated drilling for the remainder of the year will comprise both resource definition to upgrade the 40C and 50C Mineral Resource and exploration drilling targeting the 44C and 90C nickel troughs. The 44C is the interpreted position of the 40C trough, offset and north of the Alpha Island Fault and west of the Western Flanks gold deposit. The 90C represents the interpreted offset extension of the Beta West mineralization previously mined by Consolidated Minerals. Both the 44C and 90C are untested by existing drilling.

• Karora has increased the lower end of its previously announced full year consolidated 2022 production guidance to a range of between 120,000 – 135,000 ounces (previously 110,000 – 135,000 ounces). Full year 2022 AISC1 guidance has been increased to a range of US$1,100 – US$ 1,200 per ounce sold (previously US$950 – US$1,050 per ounce sold). Growth capital guidance has been moderately increased by A$5 million for 2022 to a range of A$57 million – A$70 million).

Paul Andre Huet, Chairman & CEO, commented: “The second quarter results demonstrate a strong operating performance improvement compared to the first quarter, when we faced many concurrent COVID-19 related challenges. While some of those challenges certainly remain, particularly the tight labour market for skilled workers which have impacted our cost guidance, we are now once again resuming the operational momentum that we expect to carry into our second half performance when compared to the first half.

Our second quarter gold production of 30,652 ounces represents a new quarterly production record since the acquisition of the Higginsville mill in 2019 and our AISC costs were much improved at US$1,190 per ounce sold, a tremendous 15% reduction compared to the prior quarter when we faced significant COVID-related costs. We are continuing to monitor the COVID-19 situation very closely in Western Australia and are remaining vigilant in our efforts to minimize impacts to drive costs down in the face of ongoing supply chain and labour challenges.

Driving our record quarterly ounce performance was record mined production from the Beta Hunt Mine with output of 290,000 tonnes, equating to almost 1.2 Mtpa on an annualized basis. This is a significant achievement by our operating team and provides further confidence in our ability to ramp up production from our flagship Beta Hunt Mine. Since 2019, we have taken monthly tonnages from 30,000 tonnes to now over 100,000 tonnes, all with a single ramp. The Beta Hunt expansion to double mined tonnes to 2.0 Mtpa continues to track very well with completion of the second decline expected during the first quarter of 2023, ahead of the of the original schedule for completion in the second quarter of 2023. The expansion project remains on budget, which is particularly impressive given the industry wide cost pressure we and our peers have all been challenged with.

Providing further optimism for the potential of the growing Beta Hunt Mine is our recent very strong gold exploration results. In July, we announced the best intercept to-date from the Larkin Zone of 29.8 g/t over 7.8 metres, which importantly occurred 20 metres below the existing Larkin Mineral Resource. At Western Flanks, we reported the shear mineralization has been extended by 150 metres below the existing Mineral Resource, highlighted by a drill intercept of 13.6 g/t over 5.3 metres. Both these results point towards the continued expansion potential of Beta Hunt.

Today we also published a robust Nickel PEA highlighting the nickel by-product potential of Beta Hunt. This PEA is based on just our initial Karora Resource announced in January, with significant potential for expansion remaining. The PEA outlines the low-cost nickel potential of the mine for a relatively modest capital investment of just over A$18 million (A$7 million in year one) yielding a strong pre-tax IRR of 105% for the base case and 232% for the upside case. The results further fuel our optimism for the future performance of Beta Hunt by providing significant potential to drive down gold AISC costs through growing by-product credits from nickel. On an average annual basis, the nickel by-products based on our initial resource have the potential to range between A$80 and A$100 per ounce.

Perhaps our most significant recent announcement was the closing of the Lakewood mill acquisition in July. Lakewood is a fully permitted 1.0 Mtpa gold mill which is expected to provide immediate strategic and operating benefits. Lakewood increases our nameplate milling capacity to approximately 2.6 Mtpa and, importantly, significantly de-risks our growth by eliminating the procurement, schedule and construction risks that have been associated with new capital projects in the current macro environment.

Lastly, we are pleased to increase the bottom end of our 2022 gold production guidance to a new range of 120,000 to 135,000 ounces based on our strong first half production performance. As with all mining companies this year, we have experienced elevated input cost pressures during the first half of the year, which has driven an increase in AISC1 guidance to US$1,100 per ounce to US$1,200 per ounce sold for the year. We continue to expect a stronger cost performance in the second half compared with the first half of the year.

Overall, I am extremely pleased with our second quarter results and recent announcements that demonstrate we are on the right track in both emerging from the current environment that is dominated by COVID-19 and inflationary challenges to gaining significant momentum on our drive to increase production and become a 200,000 ounce gold producer. With a robust balance sheet in place, we look forward to continuing to execute on our plan.”

1. Non-IFRS: the definition and reconciliation of these measures are included in the Non-IFRS Measures section of this news release and Karora’s MD&A dated August 12, 2022.

COVID-19 Protocols

In response to the global COVID-19 pandemic, Karora’s protocols and contingency plans have helped mitigate impacts of the pandemic, but not eliminate them. Karora’s ongoing response to the COVID-19 pandemic continues to prioritize the safety of its workforce and host communities.

Consolidated Operations

For the second quarter of 2022, 462,000 tonnes of material was milled at an average grade of 2.21 g/t to produce 30,652 ounces of gold. Tonnes milled were 17% higher than the first quarter of 2022. The feed blend through the Higginsville mill during the second quarter of 2022 comprised 59% material from the Beta Hunt underground mine with an average grade of 2.31 g/t, with the remaining 41% feed coming from the HGO operations at an average grade of 2.32 g/t, for a combined average grade of 2.31 g/t. Lower grade stockpile material from Beta Hunt was also treated through a third party mill during the second quarter of 2022, as part of the Lakewood Mill due diligence process, with an average grade of 1.34 g/t resulting in the total average grade milled of 2.21 g/t.

Beta Hunt Mine Operations

Production for the second quarter of 2022 was 295,000 tonnes milled at a grade of 2.14 g/t, a 27% increase and 8% decrease, respectively, compared to the first quarter of 2022. The higher tonnes milled and lower grade was largely due to the treatment of low grade stockpile material as noted above.

Of note, the 290,000 tonnes mined at Beta Hunt is a company record from a single decline at the mine in a single quarter. The record performance positions Karora very well for the commissioning of the second decline in the first quarter of 2023 as the Company ramps production towards its target mining rate of 2.0 Mtpa at Beta Hunt as part of the growth plan.

Higginsville (“HGO”) Mine Operations

HGO mined 106,000 tonnes during the second quarter of 2022, 49% lower than the second quarter of 2021, at an average grade of 3.28 g/t containing 11,211 ounces of gold. Lower tonnes were compensated with higher grade resulting in a 7.4% increase in mined ounces of gold compared to the second quarter of 2021.

Planned production ramped up by 86% at the Spargos open pit mine compared to the previous quarter. Planning and approvals are underway to extend the Spargos open pit at depth. Two Boys and Aquarius underground operations also contributed to mined tonnes and ounces from development material.

Tonnes milled at the HGO mill and a third-party mill during the second quarter of 2022 were 462,000 (64% from Beta Hunt and 36% from HGO), a 34% increase in tonnes compared to the second quarter of 2021, at an average grade of 2.21 g/t. Recovered gold was 30,652 ounces. Included in the recovered gold was third-party mill processed material of 51,549 ore tonnes for 2,085 recovered ounces, as part of the due diligence to acquire the Lakewood Mill. Total gold ounces sold were 30,398 ounces during the second quarter of 2022.

Cash Operating Costs and AISC1

For the second quarter of 2022 consolidated cash operating costs1 and AISC1 were US$1,130 and US$1,190 per ounce sold, decreases of 14% and 15%, respectively compared to the prior quarter.

Revenue for the second quarter of 2022 was $73.6 million, a 6% increase over the comparable period in 2021. The increase in revenue in 2022 was mainly the result of higher average realized prices on ounces sold which increased by 6%.

The net loss for the three months ended June 30, 2022 was $0.3 million compared to net earnings of $5.4 million for the comparable period in 2021, a decrease of $5.7 million. The decrease was mainly attributable to increases in production and processing costs, general and administrative costs, COVID-19 related costs and depreciation and amortization.

Adjusted net earnings1 for the second quarter of 2022 were $4.7 million, or $0.03 per share, a 67% decrease compared to the same period in 2021, primarily due to higher costs associated with the current operating environment.

Adjusted EBITDA1 for the second quarter of 2022 was $22.6 million, or $0.14 per share, compared to $29.5 million, or $0.20 per share, in the second quarter of 2021. The reduction was due to the aforementioned cost pressures.

Karora’s cash position increased to $114.1 compared to $91.0 million as at December 31, 2021.

For a complete discussion of financial results, refer to Karora’s MD&A and unaudited condensed interim financial statements for the three months ended June 30, 2022 and 2021.

Outlook

Karora has increased the lower end of its previously announced full year consolidated 2022 production guidance to a range of between 120,000 – 135,000 ounces of gold (previously 110,000 – 135,000 ounces) following strong first half 2022 production of 58,141 ounces. Full year 2022 AISC1 guidance has been increased to a range of US$1,100 – US$ 1,200 per ounce sold (previously US$950 – US$1,050 per ounce sold) to adjust for the increased input costs driven largely by COVID-19 disruptions in the first quarter of 2022, in addition to elevated sector-wide inflationary impacts during 2022. Karora continues to expect stronger second half cost performance when compared to the first half driven by improved grades and reduced cost pressures as experienced during first quarter of 2022. Growth capital guidance has been moderately increased by A$5M for 2022, driven primarily by the positive acceleration of the second decline development which is tracking ahead of original schedule and remains on track for completion in the first quarter of 2023 as well as minor upgrades to the Lakewood milling facility, offset by reduced outlays previously allocated in 2022 for the expansion of the Higginsville mill.

On June 28, 2021 the Corporation announced three-year production guidance as part of a multi-year growth plan that is expected to see gold production increase from 99,249 ounces in 2020 to a range of 185,000 – 205,000 ounces in 2024 at an AISC1 of US$885 – US$985 per ounce sold. Payable nickel production guidance for 2022 remains at 450 to 550 tonnes, which is treated as a by-product credit in AISC1.

(1) The 2022 guidance was updated August 12, 2022. 2023 and 2024 guidance was announced in January 2021 (see Karora news release dated January 19, 2021), is unchanged. This production guidance through 2024 is based on the 2020 year-end Mineral Reserves and Mineral Resources announced on December 16, 2020.

(2) The Corporation expects to fund the capital Investment amounts listed above with cash on hand and cashflow from operations, includes the capital required during the applicable periods to expand the capacity of the Higginsville mill to 2.5 Mtpa. See below for further detail regarding this expansion.

(3) The material assumptions associated with the expansion of Beta Hunt mining production rate to 2.0 Mtpa in 2024 include the addition of a second ramp decline system driven parallel to the ore body, ventilation and other infrastructure that is required to support these areas, and an expanded trucking fleet.

(4) The Corporation’s guidance assumes targeted mining rates and costs, availability of personnel, contractors, equipment and supplies, the receipt on a timely basis of required permits and licenses, cash availability for capital investments from cash balances, cash flow from operations, or from a third-party debt financing source on terms acceptable to the Corporation, no significant events which impact operations, such as COVID-19, nickel price of US$22,000 per tonne, as well as an A$ to US$ exchange rate of 0.70 in the second half of 2022 and 0.78 in 2023 and 2024. and A$ to C$ exchange rate of 0.91. Assumptions used for the purposes of guidance may prove to be incorrect and actual results may differ from those anticipated. See below “Cautionary Statement Concerning Forward-Looking Statements”.

(5) Exploration expenditures include capital expenditures related to infill drilling for Mineral Resource conversion, capital expenditures for extension drilling outside of existing Mineral Resources and expensed exploration. Exploration expenditures also includes capital expenditures for the development of exploration drifts.

(6) Capital expenditures exclude capitalized depreciation.

(7) AISC guidance includes Australian general and administrative costs and excludes share-based payment expense.

(8) See “Non-IFRS Measures” set out at the end of this news release and Karora’s MD&A dated for the period ended June 30, 2022.

The growth plan will be driven by an expansion of Beta Hunt underground mine production to 2.0 Mtpa by 2024, from 0.8 Mtpa recorded in 2020. Increased production from Beta Hunt will be complemented by ore from HGO Central and Spargos. The increased tonnage is expected to be processed by the Higginsville mill and the newly acquired Lakewood mill, which combine for approximately 2.6 Mtpa of capacity.

Further details on the growth plan can be found in Karora’s news release dated June 28, 2021, and the third quarter MD&A.

Exploration and Resource Definition Drilling

At Beta Hunt, 16,710 metres of drilling was completed during the second quarter, comprised of 13,938 metres for gold and 2,772 metres for nickel.

Gold drilling during the quarter focused on testing the down-dip extensions of Western Flanks and A Zone, targeting parallel shear zones to Larkin known as Mason and Cowcill and infill drilling the Larkin Zone.

Exploratory drilling also tested for shear-hosted gold mineralization in the Gamma block (3 holes) and at Sorrenson (2 holes). All drill targets are in support of the growth plan to increase Beta Hunt mine production to 2.0 Mtpa by 2024.

Nickel exploration and resource definition activities continued to target extensions to the 25C nickel trough in the Beta block, south of the 30C Ni Mineral Resource.

A number of significant gold intersections were reported post the first quarter and can be reviewed in Karora news releases dated May 24 2022, July 19, 2022 and August 2, 2022. Results from infill and extensional drilling of Western Flanks, A Zone and Larkin have generally supported and in some cases extended the known mineralization associated with these Mineral Resources.

Conference Call / Webcast

Karora will be hosting a conference call and webcast today beginning at 10:00 a.m. (Eastern time). A copy of the accompanying presentation can be found on Karora’s website at www.karoraresources.com.

Live Conference Call and Webcast Access Information:

North American callers please dial: 1-800-289-0720

Local and international callers please dial: 647-484-0258

A live webcast of the call will be available through Cision’s website at:

Webcast Link (https://app.webinar.net/…)

A recording of the conference call will be available for replay through the webcast link, or for a one-week period beginning at approximately 1:00 p.m. (Eastern Time) on August 12, 2022, through the following dial in numbers:

North American callers please dial: 1-888-203-1112; Pass Code: 2825394

Local and international callers please dial: 647-436-0148; Pass Code: 2825394

Non-IFRS Measures

This news release refers to cash operating cost, cash operating cost per ounce, all-in sustaining cost, EBITDA, adjusted EBITDA and adjusted EBITDA per share, adjusted earnings, adjusted earnings per share and working capital which are not recognized measures under IFRS. Such non-IFRS financial measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers. Management uses these measures internally. The use of these measures enables management to better assess performance trends. Management understands that a number of investors and others who follow the Corporation’s performance assess performance in this way. Management believes that these measures better reflect the Corporation’s performance and are better indications of its expected performance in future periods. This data is intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS.

In November 2018, the World Gold Council (“WGC”) published its guidelines for reporting all-in sustaining costs and all-in costs. The WGC is a market development organization for the gold industry and is an association whose membership comprises leading gold mining companies. Although the WGC is not a mining industry regulatory organization, it worked closely with its member companies to develop these non-IFRS measures. Adoption of the all-in sustaining cost and all-in cost metrics is voluntary and not necessarily standard, and therefore, these measures presented by the Corporation may not be comparable to similar measures presented by other issuers.

The following tables reconcile these non-IFRS measures to the most directly comparable IFRS measures:

Mining Operations

Cash Operating and All-in Sustaining Costs

The Corporation uses these measures internally to evaluate the underlying operating performance of the Australian Operations. Management believes that providing cash operating cost data allows the reader the ability to better evaluate the results of the underlying operations.

Adjusted EBITDA and Adjusted Earnings

Management believes that adjusted EBITDA and adjusted earnings are valuable indicators of the Corporation’s ability to generate operating cash flows to fund working capital needs, service debt obligations, and fund exploration and evaluation, and capital expenditures. Adjusted EBITDA and adjusted earnings exclude the impact of certain items and therefore is not necessarily indicative of operating profit or cash flows from operating activities as determined under IFRS. Other companies may calculate adjusted EBITDA and adjusted earnings differently.

Adjusted EBITDA is a non-IFRS measure, which excludes the following from comprehensive earnings (loss); income tax expense (recovery); interest expense and other finance-related costs; depreciation and amortization; non-cash other expenses, net; non-cash impairment charges and reversals; non-cash portion of share-based payments; acquisition costs; derivatives and foreign exchange loss; sustainability initiatives.

Adjusted earnings is a non-IFRS measure, which excludes the following from comprehensive earnings (loss): non-cash portion of share-based payments; revaluation of marketable securities; derivatives and foreign exchange loss; tax effects of adjustments; sustainability initiatives.

Working Capital

Working capital is calculated as current assets (including cash and cash equivalents) less current liabilities.

Compliance Statement (JORC 2012 and NI 43-101)

The disclosure of scientific and technical information contained in this news release has been reviewed and approved by Stephen Devlin, FAusIMM, Group Geologist, Karora Resources Inc., a Qualified Person for the purposes of NI 43-101.

About Karora Resources

Karora is focused on increasing gold production to a targeted range of 185,000-205,000 ounces by 2024 at its integrated Beta Hunt Gold Mine and Higginsville Gold Operations ("HGO") in Western Australia. The Higginsville treatment facility is a low-cost 1.6 Mtpa processing plant, which is fed at capacity from Karora’s underground Beta Hunt mine and Higginsville mines. Karora recently acquired the 1.0 Mtpa Lakewood Mill in Western Australia. At Beta Hunt, a robust gold Mineral Resource and Reserve are hosted in multiple gold shears, with gold intersections along a 4 km strike length remaining open in multiple directions. HGO has a substantial Mineral gold Resource and Reserve and prospective land package totaling approximately 1,900 square kilometers. The Corporation also owns the high grade Spargos Reward project, which came into production in 2021. Karora has a strong Board and management team focused on delivering shareholder value and responsible mining, as demonstrated by Karora’s commitment to reducing emissions across its operations. Karora’s common shares trade on the TSX under the symbol KRR and also trade on the OTCQX market under the symbol KRRGF.

Cautionary Statement Concerning Forward-Looking Statements

This news release contains "forward-looking information" including without limitation statements relating to the liquidity and capital resources of Karora, production guidance, full year consolidated 2022 production guidance and the potential of the Beta Hunt Mine, Higginsville Gold Operation, the Aquarius Project, the Spargos Gold Project, the commencement of mining at the Spargos Gold Mine, the Lakewood Mill, and the completion of the resource estimate.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Karora to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Factors that could affect the outcome include, among others: future prices and the supply of metals; the results of drilling; inability to raise the money necessary to incur the expenditures required to retain and advance the properties; environmental liabilities (known and unknown); general business, economic, competitive, political and social uncertainties; results of exploration programs; accidents, labour disputes and other risks of the mining industry; political instability, terrorism, insurrection or war; or delays in obtaining governmental approvals, projected cash operating costs, failure to obtain regulatory or shareholder approvals. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to Karora ’s filings with Canadian securities regulators, including the most recent Annual Information Form, available on SEDAR at www.sedar.com.

Although Karora has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Karora disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

For more information, please contact:

Rob Buchanan

Director, Investor Relations

T: (416) 363-0649

www.karoraresources.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()