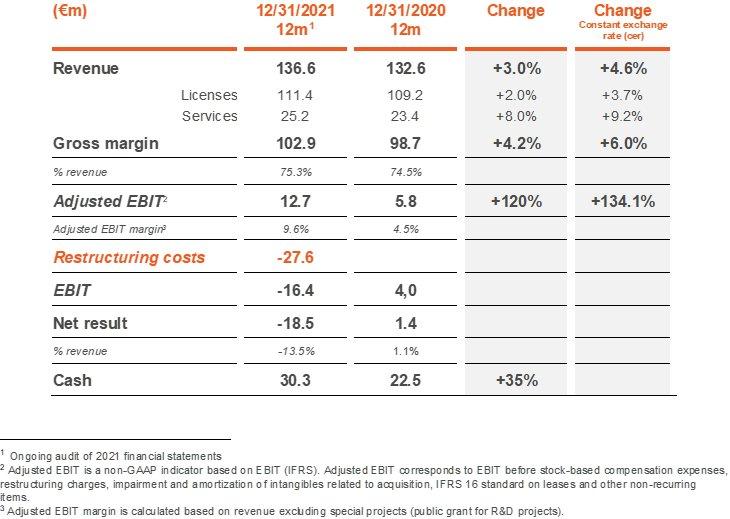

- Full year revenues at €136.6m: +4.6% YoY at constant exchange rate (cer), +3.0% at current exchange rate, at the top end of the Group’s shared guidance (€133.5m to €136.5m)

- Doubling Adjusted EBIT margin from 4.5% to 9.6%

- Healthy financial situation – Gearing improved – from 28.4% in 2020 to 17.2% in 2021

ESI Group, Rungis, France, (ISIN Code: FR0004110310, Symbol: ESI), today releases its sales and results for the full year 2021 (period from January 1st to December 31st) approved by the Board of Directors on February 28th, 2022.

“In 2021 we successfully steered our company through a governance change, announced our redefining 3-year strategic plan and demonstrated considerable performance improvements. We reignited growth and more than doubled our Adjusted EBIT margin. On this excellent foundation we now enter the 1st year of our “OneESI 2024 – focus to grow” plan. Across the globe, all our stakeholders are now experiencing the early benefits of this significant change in our ability to focus and drive results. I am confident in our ability to deliver our communicated multi-year objectives and long-term value to our shareholders by repositioning our Group.”

– Cristel de Rouvray, Chief Executive Officer of ESI Group

2021, a foundational year for ESI Group

2021 results show that ESI Group continues delivering on its commitments. FY21 marks the first significant improvement in profitability, the result of actions initiated over a year ago while reigniting growth.

ESI Group generated revenues at the top end of the range communicated to the market (between €133.5m and €136.5m) at €136.6m in 2021, up 4.6% at constant exchange rate (cer). For licenses, repeat business (Renewals + Add-ons) grew by 3.7% (cer) to €99.1m and new business grew by 8.6% (cer). For services, consulting activity revenues increased by 9.6% cer at €24.8m. Q4 revenues amounted to €30.6m (vs €29.9m in 2020), up 2.2% cer, for an H2 growth of 5.8% cer.

The geographical breakdown of full-year revenues showed that all regions grew: the EMEA region +4.5% (cer), Asia +2.7% (cer) and the Americas +10% (cer). Asia and Americas were negatively impacted by Forex (-3.5% for Asia and -3.7% for Americas).

In 2021, led by a renewed leadership team, ESI Group embarked on its 3-year strategic plan “OneESI 24 – Focus to grow” (more info HERE) by initiating parallel and complementary projects aiming to transform its operating model and practices. The Group continued investing in talent, in its offerings, and its products within a healthy run-rate framework to help drive cost reductions (headcount – 6%, costs to adjusted Ebit -2.3%). The growth of the topline of €4.0m, combined with costs reduction, led to an increase in Adjusted EBIT of €6.9m.

Gross margin rate increased to 75.3% vs 74.5% in 2020 due to higher licensing and consulting gross margins. In 2021, staff costs decreased to €91.3 m vs €93.4m last year. The Group reduced its headcount as announced during its 2021 Investor’s conference – from 1,217 (end of December 2020) to 1,144 (end of December 2021).

Impact of strategic plan on figures: Restructuring impact

To increase its competitiveness, ESI implemented a transformation of its management and a reduction in headcount in the various regions of the Group in accordance with the legal rules applicable to each of them. ESI also decided to disengage from non-core software development projects or non-strategic research projects outside the Group’s three offerings.

The impacts of this restructuring and transforming plan are estimated to costs €27.6m, in line with plan, comprising mainly:

- Provisions for reduction in headcount – already notified: €6.7m (Cash impact). This is in line with the headcount reduction that the Group announced to the market. The Group is passed the mid-point and on track to complete this initiative by end of December 2022.

- Impairment of intangibles as related to products & services deemed non-core: €20.7m (no cash impact)

A healthy financial situation

In 2021, ESI Group demonstrated its capacity to improve its financial situation. ESI Group controlled its costs, reduced its debt (from €24.9m in 2020 to €12.5m in 2021) and significantly improved its gearing (net debt /Equity) from 28.4% in 2020 to 17.2% in 2021.

The Group has significantly increased its cash position end of year from €22.5m to €30.3m thanks to a substantial free cash flow of €10.9m.

All teams mobilized to deliver on OneESI 2024 plan

The Group is confident in its strategic plan:

- Industry continues to accelerate the transformation of their production to a faster, more profitable, and more environmentally friendly model. The pandemic has accelerated this process and shifting from physical to virtual test and prototypes became a priority.

- ESI Group’s core offering & packaging focuses on product performance simulation, smart manufacturing process simulation and human workflows simulation. As announced during its strategic plan presentation, the Group is redeploying significant software development resources and innovation efforts on offer priorities.

- In that context, ESI’s solutions are mission-critical for its customer base.

- ESI’s customers continuously give credits to ESI’s added value:

- Ford Leverages Virtual Prototyping to Propel Lightweighting Capabilities to the Next Level – HERE

- SEAT S.A. Technical Center and ESI Group set new car development standards towards 100% digital with the brand-new CUPRA Formentor – HERE

- Volvo Trucks unleashes the possibilities of Virtual Prototyping for optimizing acoustic performance

- Kone anticipates elevator breakdowns and optimizes product design using Digital Twins for predictive/ prescriptive maintenance

- To align with best practices, the Group is working to re-align its pricing practices. This critical workstream will impact the Group’s performance more visibly in FY23 and beyond.

- As in the past two years, a proactive cost control policy has been implemented. Many of the restructuring costs have been charged to the year 2021 without reducing the R&D costs. There will certainly be more investments to support growth, but the foundations are solid with clear strategy of focus.

The Group will organize an investor’s conference in early Fall 2022 and will give an update on the plan and extend its guidance to 2025.

These statements are subject to a number of risks and uncertainties, including those related to the COVID-19 virus and associated further economic and market disruptions; further adverse changes or fluctuations in the global economy; further adverse fluctuations in our industry, foreign exchange fluctuations, changes in the current global trade regulatory environment; fluctuations in customer demands and markets; fluctuations in demand for our products including orders from our large customers; cyber-attacks; expense overruns; and adverse effects of price changes or effective tax rates. The company directs readers to its Universal Registration Document – Chapter 3 presenting the risks associated with the company’s future performance.

Founded in 1973, ESI Group envisions a world where Industry commits to bold outcomes, addressing high stakes concerns – environmental impact, safety & comfort for consumers and workers, adaptable and sustainable business models. ESI provides reliable and customized solutions anchored on predictive physics modeling and virtual prototyping expertise to allow industries to make the right decisions at the right time, while managing their complexity. Acting principally in automotive & land transportation, aerospace, defense & naval, energy and heavy industry, ESI is present in more than 20 countries, employs 1200 people around the world and reported 2020 sales of €132.6 million. ESI is headquartered in France and is listed on compartment B of Euronext Paris.

For further information, go to www.esi-group.com.

Engineering System International GmbH

Siemensstr. 12

70565 Stuttgart

Telefon: +49 (6102) 2067-0

Telefax: +49 (6102) 2067-111

http://www.esi-group.com

E-Mail: marketing.germany@esi-group.com

Corporate and Financial Communication Manager

E-Mail: investors@esi-group.com

![]()