Highlights

- 34 g/t gold over 110.6 meters including 12 g/t gold over 13.7 meters and 8.8 g/t gold over 11.8 meters1 in BT21-240D;

- BT21-240D intersected the Panther Creek Shear Zone (“PCSZ”) in the Joss target area at about 430 meters downhole (about 350 meters depth) mid-way along strike between drill holes BT21-237D and BT21-238D; and,

- Further analysis and interpretation are pending.

1 True width is estimated to be between 35% and 45% of drilled width. Un-cut fire assay grades.

“This is a game-changing hole as it hosts the highest-grade gold intersections released to date from the Joss target area. With BT21-240D we are now beginning to see the full potential of the Beartrack-Arnett gold project”, said Hugh Agro, President & CEO. “The high grades and substantial widths of mineralized structure encountered in BT21-240D reinforce our enthusiasm for the project’s underground potential and the possibility of it being developed into a highly profitable and long-life mining operation. We have had a very high success rate drilling in the PCSZ along more than 5 km of strike and we look forward to the resumption of drilling at Joss in the new year,” added Agro

Five holes were drilled in the Joss target area in 2021. Holes BT21-237D, BT21-238D and BT21-240D all intersected mineralization within the PCSZ. Holes BT21-236D and BT21-239DB were abandoned before intersecting the PCSZ in post-mineralization Tertiary rocks due to difficult drilling conditions. However, drill hole BT21-239DB intersected fracture-controlled sericite alteration in metasediments of the Yellowjacket Formation, the host rock for mineralization in the Joss area. Geochemical analysis confirmed the presence of weakly anomalous gold and arsenic values before the hole encountered an unexpected post-mineral fault that may have displaced the continuation of Joss mineralization in this area. While the direction and amount of displacement is unknown at this time, this result suggests that mineralization may extend south along strike beyond current limits of drilling.

The PCSZ is the main structure which hosted mineralization exploited by the previous Beartrack mining operation and, as such, Joss is close to existing infrastructure including powerlines, roads, and other site facilities.

Detailed results for hole BT21-240D, released today, along with results previously released for adjacent drill holes BT21-237D and BT21-238D, are presented in the table below:

The Joss Target

Mineralization was discovered in the Joss area in 1991 by FMC Gold Company. Eight shallow reverse circulation holes were drilled that year, confirming the presence of mineralization with hole L007 intersecting 1.52 g/t gold over 30.5 meters beginning at 50 meters down hole depth, including 4.6 g/t gold over 3 meters.

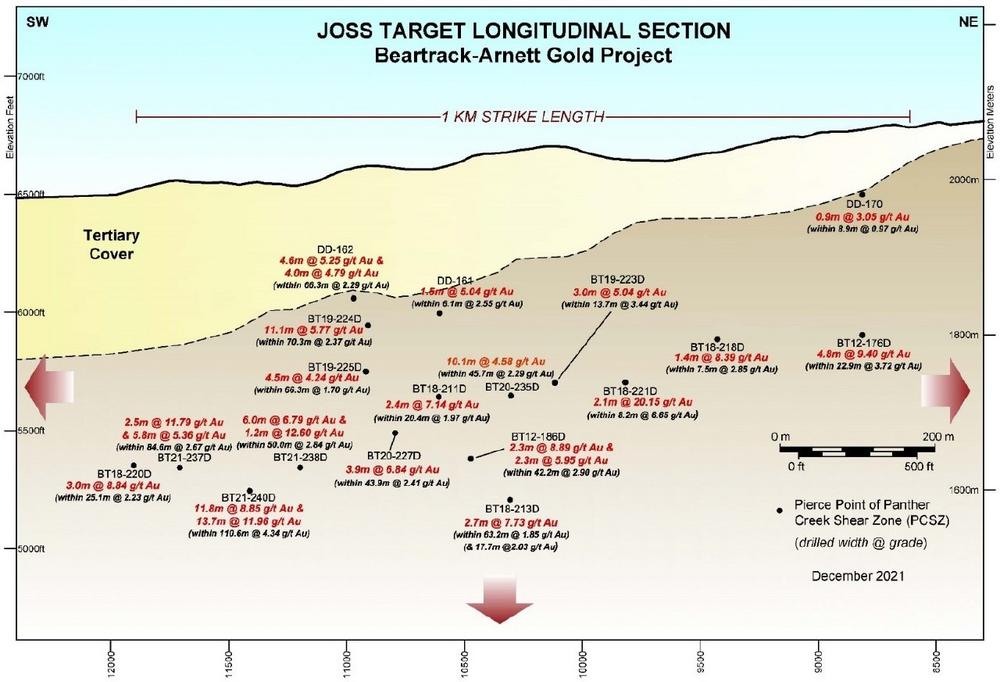

Since 1997, 21 core holes totaling 8,420 meters have been completed over more than one kilometer of strike in the Joss area. All eighteen holes that intersected the PCSZ encountered mineralization. Those that did not intersect the PCSZ had been abandoned prior to reaching the target.

Drill holes that reached the target structure at Joss intersected broad intervals of lower-grade mineralized ranging from 2-4 g/t gold containing narrower, higher-grade intervals with grades ranging from 4 -11 g/t gold over true widths of 1 – 5 meters. Higher-grade mineralization extends northward from Joss into the South Pit area and mineralization is open to the south. Mineralization at Joss has been drilled to about 500 meters depth and, like mineralization elsewhere at Beartrack, is open at depth.

Over the past year, Revival Gold and the Company’s engineering consultants have been evaluating the potential for narrow vein and bulk underground mining and milling at Beartrack-Arnett. Potential higher-grade, underground material in the Joss and South Pit areas offers the opportunity to supplement lower-grade, open pit mill material in any potential mine plan that might be developed for the site.

Underground development concepts under strategic review include conventional ramp-access supporting mechanized mining with truck haulage and long hole open stoping mining methods. The narrower, higher-grade zones could potentially support mining rates in the range of 1,000 tonnes/day to 2,000 tonnes/day, while the lower-grade, bulk mining areas could potentially support mining rates in the range of 2,000 tonnes/day to 4,000 tonnes/day. The sub-vertical orientation of the mineralized zone and continuity along strike are favorable attributes for underground productivity. Geotechnical logging of the diamond drill core is assisting with evaluating rock stability design considerations.

Figure 1 below is a long section view of the Joss target area showing a preliminary interpretation of the setting and drill hole intercepts for all holes drilled at Joss to-date.

QA/QC Program

Quality Assurance/Quality Control consists of the regular insertion of certified reference materials, duplicate samples and blanks into the sample stream. Check samples are submitted to an umpire laboratory at the end of the drilling program. Sample results are analyzed immediately upon receipt and all discrepancies are investigated. Samples are submitted to the ALS Geochemistry sample preparation facility in Twin Falls, Idaho. Gold analyses are performed at the ALS Geochemistry laboratory in Reno, Nevada or Vancouver, British Columbia, and multi-element geochemical analyses are completed at the ALS Minerals laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab.

Gold assays are determined on samples consisting of half drill core by fire assay and AAS on a 30-gram nominal sample weight (Au-AA23) for Beartrack, and Fire Assay and AAS on a 50-gram nominal sample weight (Au-AA24) for Arnett. For shallow holes, targeting leachable mineralization, gold is also determined by cyanide leach with an AAS finish on a nominal 30-gram sample weight (Au-AA13). Multi element geochemical analyses are completed on selected drill holes using the ME-MS 61M method.

Qualified Person

Steven T. Priesmeyer, C.P.G., Vice President Exploration, and Rodney A. Cooper, P.Eng., a QP and a consultant to Revival Gold Inc., are the Company’s designated Qualified Persons for this news release within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects and have reviewed and approved its scientific and technical content.

About Revival Gold Inc.

Revival Gold Inc. is a growth-focused gold exploration and development company. The Company is advancing the Beartrack-Arnett Gold Project located in Idaho, USA.

Beartrack-Arnett is the largest past-producing gold mine in Idaho. A Preliminary Economic Assessment has been completed for a first phase restart of heap leach operations to produce 72,000 ounces of gold per year over an initial seven-year mine life at an AISC of $1,057 per ounce of gold. Meanwhile, exploration continues, focused on expanding the current Indicated Mineral Resource of 36.6 million tonnes at 1.15 g/t gold containing 1.36 million ounces of gold and Inferred Mineral Resource of 47.1 million tonnes at 1.08 g/t gold containing 1.64 million ounces of gold. The mineralized trend at Beartrack extends for over five kilometers and is open on strike and at depth. Mineralization at Arnett is open in all directions.

For further details, including key assumptions, parameters and methods used to estimate the Mineral Resources, and data verification, please see the Company’s NI 43-101 compliant technical report titled, “Preliminary Economic Assessment of the Heap Leach Operation on the Beartrack Arnett Gold Project, Lemhi County, Idaho, USA – NI 43-101 Technical Report”, dated December 17th, 2020.

Revival Gold has approximately 71.4 million shares outstanding and had a cash balance of C$3 million on September 30th, 2021. Additional disclosure including the Company’s financial statements, technical reports, news releases and other information can be obtained at www.revival-gold.com or on SEDAR at www.sedar.com.

For further information, please contact:

Hugh Agro, President & CEO or Lisa Ross, CFO

Telephone: (416) 366-4100 or Email: info@revival-gold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. Technical information in this news release has been reviewed and approved by Steven T. Priesmeyer, C.P.G., Vice President Exploration, Revival Gold Inc., and Mr. Rodney A. Cooper, P.Eng., a consultant to the Company, Qualified Persons within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

This News Release includes certain “forward-looking statements” which are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company’s future plans, objectives or goals, including words to the effect that the Company, or management, expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as “believes”, “anticipates”, “expects”, “estimates”, “may”, “could”, “would”, “will”, or “plan”. Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management’s expectations. Risks, uncertainties and other factors involved with forward-looking information could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes, but is not limited to, the Company’s intentions regarding its objectives, goals or future plans and statements. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the Company’s ability to predict or counteract the potential impact of COVID-19 coronavirus on factors relevant to the Company’s business, failure to identify additional mineral resources, failure to convert estimated mineral resources to reserves with more advanced studies, the inability to eventually complete a feasibility study which could support a production decision, the preliminary nature of metallurgical test results may not be representative of the deposit as a whole, delays in obtaining or failures to obtain required governmental, environmental or other project approvals, political risks, uncertainties relating to the availability and costs of financing needed in the future, changes in equity markets, inflation, changes in exchange rates, fluctuations in commodity prices, delays in the development of projects, capital, operating and reclamation costs varying significantly from estimates and the other risks involved in the mineral exploration and development industry, and those risks set out in the Company’s public documents filed on SEDAR. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()