Sample material for the metallurgical testwork was obtained from the Company’s auger drilling program, completed in May (see press release dated May 20, 2021). The sample material was composited by Activation Laboratories Ltd. before being sent off to Base Metallurgical Laboratories Ltd, both of Kamloops, British Columbia, for cyanide leach analysis. A total of six sample composites were sent for testing.

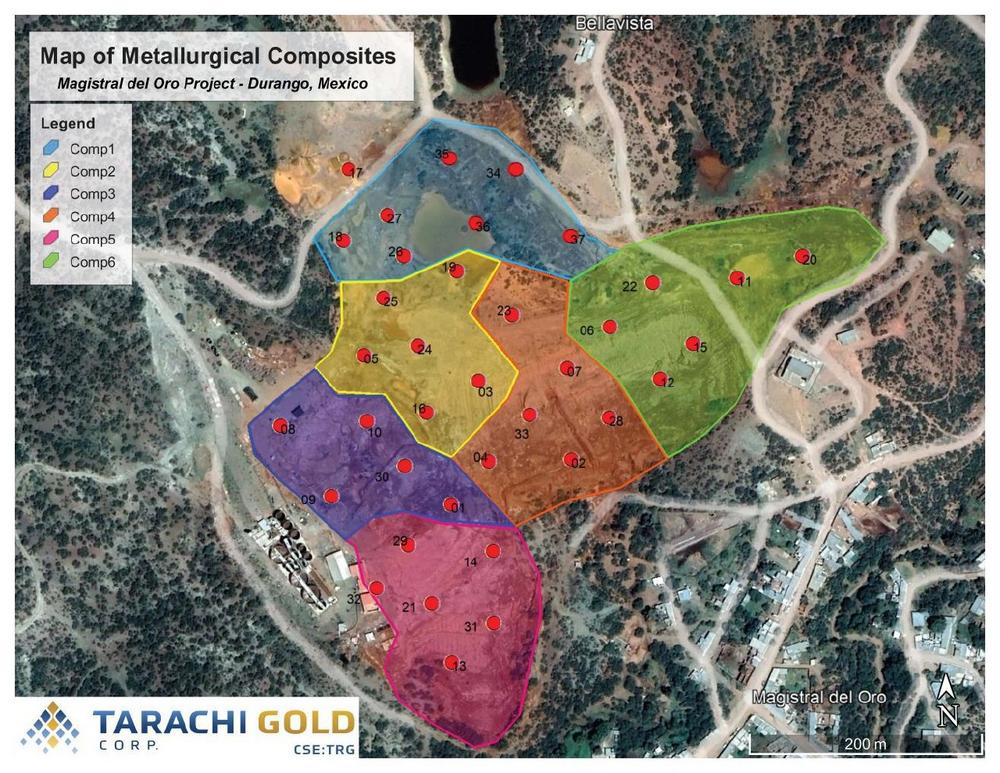

Each composite was made from material from a grouping of five to seven drill holes. Table 1 shows the drill holes used for each composite and Figure 1 shows the areas of the tailings basin covered by each composite.

The six composites were assayed to determine head grade for gold, silver, and copper. Material from each composite was split off to test for gold recovery by cyanide leach at three different grind sizes. The first sample from each composite was leached on an as-received basis without any grinding, the second sample was leached after a 1-minute polish grind and the final leach test was with a target P80 grind size of 75µm. Leach testing on material with a target size of 75µm was not undertaken for Composites 3 and 5 as material from those composites reached the target size after the 1-minute polish grind. Leach testing was conducted using the standard bottle-roll method with assays of the solution taken after 2, 6, 12, 24 and 48 hours. A cyanide concentration of the leach solution was maintained at 2.0g/L NaCN with lime added to maintain a target pH of 11.5. Results of the head assays and leach recoveries are summarized in Table 2. Total lime and sodium cyanide consumption for the 12 and 48-hour leach tests can be found in Table 3.

Tarachi CEO, Cameron Tymstra, commented: “The latest leaching results for Magistral strongly indicate our processing plant’s ability to leach and recover a significant portion of the contained value in the tailings material with minimal effort. We have always looked at Magistral as not just a means to generate significant cash flow for Tarachi, but to do so with one of the smallest carbon footprints per ounce of gold in the industry. As the international community moves to a lower-carbon economy, it is becoming essential for miners to ensure the commodities we produce lead the way in reducing the carbon emissions of the World’s supply chains.

With the tailings assay grades previously announced averaging 2.04g/t Au and the strong gold recoveries released today; the data continues to support our goal of producing a minimum of 15,000 ounces of gold per year at Magistral.”

Overall, leach kinetics of the Magistral tailings material was determined to be favourable with gold recovery of greater than 80% achieved in 12 hours in almost every sample run with an average recovery of 83.1% in 12 hours on the as-received material. Additional grinding of the tailings material did not result in a substantial improvement in gold recovery, suggesting that gold can be leached and recovered from the Magistral tailings with a very low total energy input compared to conventional ore that needs to be crushed and ground prior to recovery. The facility includes an unused ball mill that will likely be included in the plant circuit to ensure tailings material is sufficiently slurried prior to leaching with minimal need to reduce actual particle size.

The existing processing facility at Magistral consists of four 7.6-metre by 9-metre agitated leaching tanks with a capacity to leach 1,000 tonnes of tailings material per day at a leach time of 16 hours. Today’s leaching results indicate that the existing leaching capacity at Magistral is more than sufficient to achieve near-maximum gold recovery with little, if any, additional recovery seen at longer retention times in the test work.

The facility’s existing counter-current decantation (“CCD”) system is expected to produce gold recovery efficiencies of 90.6%. At a gold leachability of 80-83%, total plant gold recovery is expected in the range of 72.5 to 75%. The Company and Ausenco Engineering are considering options as part of the PEA that could potentially improve total plant gold recovery. Such options could include the addition of an extra CCD tank, increasing wash water flow and switching from conventional tailings to filtered tailings.

Lime and sodium cyanide consumption rates per tonne of material can be found in Table 3. Lime and cyanide consumption averaged 3.37kg and 3.30kg per tonne of ore, respectively, on as-received material after 12 hours of leaching. Much of the cyanide consumption has been attributed to the presence of cyanide-soluble copper in the tailings material. The copper grade of the 171 gold tailings samples from the Company’s auger drilling program averaged 0.176%Cu, with approximately half of the copper expected to be cyanide soluble. The Company and Ausenco Engineering are currently looking at ways to manage the copper content of the tailings and potentially mitigate some of its dissolution into the cyanide solution with the goal of reducing cyanide consumption. Copper by-product production is also being considered as a secondary revenue stream for the project.

Quality Assurance/Quality Control

Tailing samples were selected by company geologists with each sample placed into plastic bag. Sample tags were inserted into each bag before being sealed and stored at the campsite in a secure area. At the completion of the program the samples were transported by company trucks directly to Tarachi’s secure facility in Hermosillo, Mexico for transport to Canada.

All 178 samples from the 37 vertical, auger drill holes completed were shipped to Activation Laboratories Ltd. in Kamloops B.C. Canada for sample preparation and analysis. 30 grams from each sample was analyzed for gold by Fire Assay Fusion with an AA (atomic absorption finish) as well, 0.5 grams of each sample was digested by Agua Regia and then analyzed using an ICP for a 38 element suite. Activation Laboratories is ISO/IEC 17025:2017 and ISC 9001: 2015 accredited and/or certified.

Control samples comprising of certified reference samples, duplicates and blanks were systematically inserted into the sample stream and analyzed as part of the company’s quality assurance / quality control protocol.

The remainder of the samples were then delivered to Base Metallurgical Laboratories, also in Kamloops to complete all metallurgical studies requested.

About Tarachi Gold

Tarachi Gold is a Canadian-listed junior gold exploration company focused on exploring and developing projects in Mexico. Tarachi acquired the Magistral Mill and tailings project in Durango, Mexico in 2021. Magistral includes a 1,000 tpd mill and access to a tailings resource (non-compliant with NI 43-101) estimated to contain 1.29Mt at 2.06g/t Au which the Company expects to bring into production in 2022. The historical estimate was completed by Corporation Ambiental de Mexico S.A. de C.V. (CAM) in 2011 which helped only in determining the drill collar locations of the Company’s recently completed drilling program as part of the ongoing Magistral preliminary economic assessment (PEA). Tarachi’s qualified person has not done sufficient work to classify the historical estimate as a current mineral resource or mineral reserves. Tarachi is not treating the historical estimate as a current mineral resource or mineral reserves.

The Company is also exploring on 3,708ha of highly prospective mineral concessions in the Sierra Madre gold belt of Sonora, Mexico in close proximity to Alamos Gold’s Mulatos mine and Agnico Eagle’s La India mine.

Qualified Person

Lorne Warner, P.Geo, VP Exploration and Director of the Company is a qualified person as defined by National Instrument 43-101 and has reviewed and approved the scientific and technical disclosure in this news release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain “Forward‐Looking Statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward‐looking information” under applicable Canadian securities laws. When used in this news release, the words “anticipate”, “believe”, “estimate”, “expect”, “target”, “plan”, “forecast”, “may”, “would”, “could”, “schedule” and similar words or expressions, identify forward‐looking statements or information. These forward‐looking statements or information relate to, among other things: future exploration programs, and the completion of drill holes; and receipt of assay results.

Forward‐looking statements and forward‐looking information relating to any future mineral production, liquidity, timing of completion of reports and studies, enhanced value and capital markets profile of Tarachi, future growth potential for Tarachi and its business, and future exploration plans are based on management’s reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of silver, gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; Tarachi’s ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect Tarachi’s respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward‐looking statements or forward-looking information and Tarachi has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company’s dependence on one mineral project; precious metals price volatility; risks associated with the conduct of the Company’s mining activities in Mexico; regulatory, consent or permitting delays; risks relating to reliance on the Company’s management team and outside contractors; risks regarding mineral resources and reserves; the Company’s inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company’s interactions with surrounding communities and artisanal miners; the Company’s ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption “Risk Factors” in Tarachi’s management discussion and analysis. Readers are cautioned against attributing undue certainty to forward‐looking statements or forward-looking information. Although Tarachi has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. Tarachi does not intend, and does not assume any obligation, to update these forward‐looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable law.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

E-Mail: cameron@tarachigold.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()