Highlights of SRK’s Review

- Gold grades at the Lomero-Poyatos Project are some of the highest known in the Iberian Pyrite Belt.

- Previous exploration done on the project has identified mineralization over a strike of over 1 km and with a vertical extension of 400 m. The deposit remains open along strike and at depth.

- SRK’s analysis of the average gold grades within the drilling show a potential increase in the average grades from 3.0 – 3.1 g/t Au (surface only) to 3.7 – 3.8 g/t Au, when considering the underground holes.

Serafino Iacono, Executive Chairman and Interim CEO of Denarius, commented, “With SRK’s consolidation of available information from previous explorers, we now have an increased knowledge base for the Project to define the geological framework and provide estimates of the potential tonnage and grade ranges. This first step sets the stage for further development of the Project, and we are excited that the gold grades are some of the highest known in the Iberian Pyrite Belt.”

The Lomero-Poyatos Project (the “Project” or “Lomero”) is a polymetallic deposit located on the northern limbs of the prolific copper-rich IBP, one of the largest districts of pyrite-rich massive sulphide deposits in the world. Within the IPB there are eight major mining areas, each reported to contain more than 100 million tonnes of ore. The Project is about 10 km west of the operating Aguas Tenidas mine, owned by Minas de Aguas Tenidas (MATSA), and 3.3 km east of the abandoned San Telmo mine.

The mine has a long history of production with mining origins as early as Roman times from two historic open pits, Lomero and Poyatos and continued underground mining during the last century. The Project is reported to have produced about 2.6 metric tonnes (Mt) of pyrite mineralization grading 5 g/t Au, 80 g/t Ag, 1.20% Cu, 1.10% Pb and 2.91% Zn from different orebodies. The gold grades at the Project, deduced from the sampling and exploration data, are some of the highest known in the IPB.

Two VMS lenses striking E-W and dipping to the north are seen at surface as gossanous outcrops worked in the two open pits (Lomero and Poyatos) occurring in the west of the permit. The VMS lenses dip moderately to shallowly to the north and combine at depth to form one deposit over 1 km in strike length. The average thickness of massive sulphide, based on drillhole intersections, is about 7.5 m, although the maximum thickness of massive sulphide exceeds 20 m. The deposit remains open along strike and at depth and further exploration is planned to test for extensions.

The deposit consists of pyrite, sphalerite, galena, chalcopyrite, tennantite-tetrahedrite, minor arsenopyrite, barite, pyrrhotite and gold. Initial mineralogical work has shown that the deposit contains at least three different mineralization types: Cupriferous material, Pyritic material containing gold credits only, and Polymetallic material containing mainly Zn+Pb+Au+Ag.

Numerous Mineral Resource estimates have been completed on the Project by previous explorers. These estimates are not considered as current and SRK will perform further work to reconfirm the tonnage and grades at Lomero.

Note: Mineral Resources are reported in total with no breakout for classification used at the time of reporting. SRK cautions the reader that these estimates should not be considered as current and should not be relied upon but have been shown to provide context on the variation in the potential size of the deposit.

Denarius has commissioned SRK to act as independent engineers and qualified persons for the review and assessment of the Project and to develop a strategic plan to advance the Project to an advanced exploration project and the declaration of Mineral Resources by the second half of 2021.

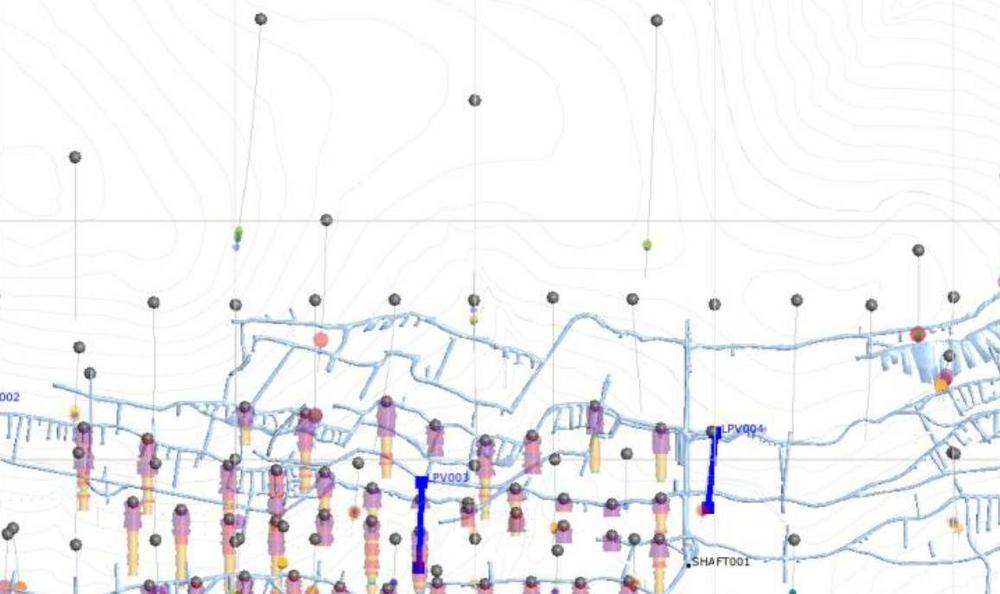

To date, a total of 98 surface holes and 61 underground holes have been completed on the Project by the previous owners for a subtotal of 23,471.8 m. Drilling has been completed in the upper portion from surface to a drill spacing of approximately 50 x 50 m but has been completed post mining so a number of the shallow holes have intersected the historical mining voids and could result in a low bias, with the majority of the sampling occurring in the footwall of the mineralization. The previous exploration has identified mineralization over a strike of over 1 km and with a vertical extension of 400 m.

The underground drilling reporting to have occurred post mining and targeted the existing pillars to test for remaining mineral resources. Limited detail on the holes exist and further verification work will be required to confirm the higher grades reported within the drilling. Analysis of the average gold grades within the drilling show a potential increase in the average grades from 3.0 – 3.1 g/t Au (surface only) to 3.7 – 3.8 g/t Au, when considering the underground holes. It is SRK’s view that this highlights the potential impact on future Mineral Resource estimates, and the requirements for further verification drilling.

SRK has created a number of scenarios to assess the potential for the Project. SRK used geological volumes and high-level estimates of the grade continuity. SRK has defined the ranges for the potential exploration targets within approximately 75 m of the existing exploration. All volumes were clipped to the current permits but it is assumed the mineralization continues along strike in both directions and at depth beyond these current ranges.

The potential quantity and grade ranges noted below are conceptual in nature and insufficient exploration has been conducted to define this material as a Mineral Resource. It is uncertain if further exploration will result in these exploration target estimates being delineated as Mineral Resources or converted to Mineral Reserves in the future. SRK cautions that estimates of exploration targets are not a CIM-defined category, are not Mineral Resources and are too speculative to fulfill the definition of Mineral Resources.

Based on the analysis SRK considers the exploration potential for Lomero to be as follows:

SRK has planned a phased drilling program of approximately 23,500 m drilling, which is targeted to provide:

- Validation drilling – 8 diamond drillholes, totaling 1,600 m to be conducted by twining of selected historical holes covering a spatial range of the deposit (Figure 1).

- Infill Drilling – 56 diamond drillholes, totaling 15,600 m, designed to produce a 50×50 m drilling pattern in the lower levels of the existing mining operation and provisional geological model. The infill drilling (Figure 2) has been designed to increase the confidence in the estimates to an Indicated Mineral Resources, and to aid in the identification of different mineralization styles. The use of orientated core supplemented with televiewer information will increase the confidence in the structural controls on the project and geotechnical and hydrogeological modelling.

- Extensional Drilling – 17 diamond drillholes, 6,300 m – to initially explore around the currently known margins of the deposit and test geophysical anomalies within the property. The downhole program has been designed to intersect potential depth extensions at a range of approximately 100 m down-dip of the current known mineralization. Drilling will be spaced on section lines approximately 100 – 120 m along strike.

The current mineralization remains open along strike and at depth, and if extensions are identified further exploration maybe warranted, which could be included and has been budgeted to increase the total drilling meters to 60,000 meters. The estimated cost for the exploration field program is approximately US$4.0 million and, using four diamond drilling rigs, should be completed within six to nine months once permitting is approved.

All drilling will be completed using a combination of PQ and HQ depending on the depth extents, and Denarius is currently in the process of developing a detailed exploration plan which has been submitted to the Andalucia Mining Authorities to obtain the required permits to commence work. Denarius have identified a drilling contractor and signed an initial contract and once approved Denarius plan to mobilize and start drilling as soon as possible to advance the Project.

In addition to the exploration drilling the Company will begin undertaking a number of engineering scopes of work in tandem with the drilling program, to advance the understanding on other key aspects for the Project including metallurgical sampling, comminution studies, mineralogical studies, geotechnical assessment for open pit and underground requirements, hydrogeological assessment, geochemical analysis and down-hole geophysics.

It is estimated that this program of work plus the necessary design engineering studies will be completed over the next 18 months, with the aim of declaring Mineral Reserves for the Project at this time. The key aspect listed above will be to obtain and advance the metallurgical test work, for which Denarius have already begun exploring options for suitable commercial and mine laboratories in the region to conduct the testwork.

Denarius will continue to update the market on the progress of the drilling and dependent on drilling results move the project towards an advanced exploration project and complete a preliminary economic assessment to consider the various mining and processing options during the exploration program.

Qualified Persons Review

The scientific and technical information in this news release has been reviewed and approved by Ben Parsons, Principal Consultant (Resource Geology) with SRK, a “Qualified Person” as defined under National Instrument 43-101.

About Denarius

Denarius is a Canadian-listed public company engaged in the acquisition, exploration, development and eventual operation of mining projects in high-grade districts, with its principal focus on the Lomero Project in Spain and the Guia Antigua Project in Colombia. The Company also owns the Zancudo Project in Colombia which is currently being explored by IAMGOLD Corp. pursuant to an option agreement for the exploration and potential purchase of an interest in the project.

Additional information on Denarius can be found on its website at www.denariussilver.com and by reviewing its profile on SEDAR at www.sedar.com.

On Behalf of the Board of Directors,

DENARIUS SILVER CORP.

Serafino Iacono, Executive Chairman and Interim CEO

Email: investors@denariussilver.com

Website: www.denariussilver.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Statements included in this announcement, including statements concerning our plans, intentions and expectations, which are not historical in nature are intended to be, and are hereby identified as, “forward‐looking statements”. Forward‐looking statements may be identified by words including “anticipates”, “believes”, “intends”, “estimates”, “expects” and similar expressions. The Company cautions readers that forward‐looking statements, including without limitation those relating to the Company’s future operations and business prospects, listing of the Warrants and use of proceeds from the Financing are subject to certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward‐looking statements.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()