Swiss passenger car market in May 2020

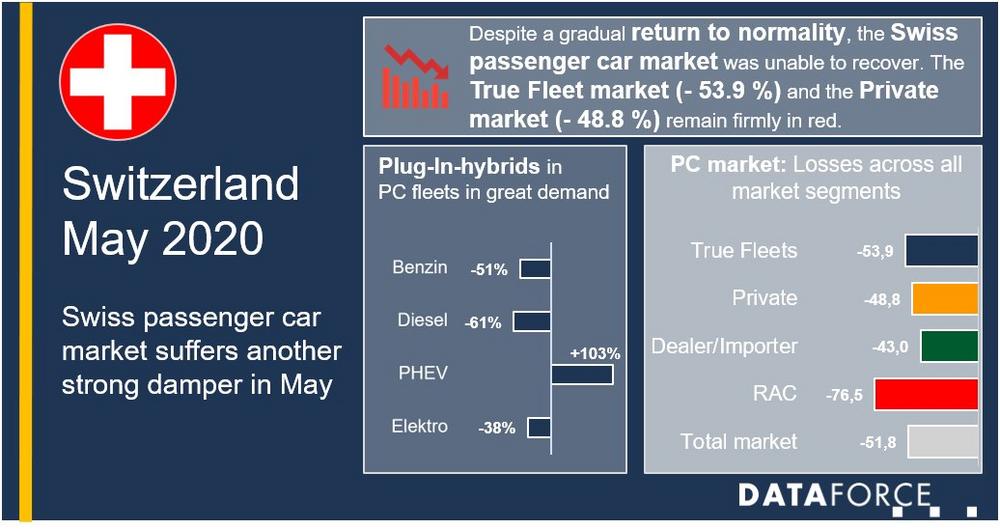

Despite the positive developments in the fight against the spread of the corona virus, the Swiss passenger car market was again confronted with the severe impact of the pandemic in May. While the private market fell by 48.8%, commercial registrations even fell by 55.2%. This meant that the overall passenger car market in Switzerland suffered a further slump of 51.8% compared with the same period last year.

The True Fleet market recorded the largest registration volume within the commercial detail channels. The company registrations fell by 53.9% compared with the same month last year. Even more affected were the registrations of car short-term rental companies, which slumped by 76.5% this year, in view of what is likely to be a much weaker holiday season. Combined registrations for Dealers/Importers in May were 43.0% down on the same month last year.

True fleet market: Importers deep in the red, Mercedes GLE in demand

In the True Fleet market, the top 25 vehicle importers were all deep in the red. Opel was hit hardest with a 74.6% slump. SEAT (- 71.8%) and Nissan (- 68.8%) were also particularly hard hit.

Within the top 10 fleet models, however, the Peugeot Partner (+ 488.9%) and the VW T-Cross (+ 450.0%) generated strong growth, due to both models still showing a relatively low level in the same month of the previous year. The performance of the Mercedes GLE (+ 273.7%), which, as in April, was in great demand by Swiss fleet managers, should therefore be rated more highly. An extended look at the top 20 fleet models also showed a successful month for the Fiat Panda (+ 88.2%).

Plug-in hybrids grow despite crisis

An analysis of the fuel development within Swiss company fleets showed a decline in the number of pure gasoline (- 51.2%) and diesel-powered (- 61.3%) cars. By contrast, the so-called mild hybrids, which Dataforce also considers to be among the aforementioned fuel types, recorded an increase.

Plug-in hybrids were also in high demand (+ 103.0%), with the BMW X5, the Volvo XC60 and the Ford Kuga making up the top three. Registrations of electric vehicles declined by 38.2% compared to the same month last year.

Market development of light commercial vehicles up to 3.5t

In addition to passenger car registrations, registrations of light commercial vehicles up to 3.5 tons also dropped significantly. Both the Private market (- 34.3%) and Commercial registrations (- 37.8%) fell last May, causing the overall market to contract by 37.1% compared with the same month last year.

The commercial retail channels also presented themselves deep in the red. While company registrations in the True Fleet market fell by 38.2%, combined registrations in the Dealer/Importer sector fell by 27.1%. Here, too, the Car rental channel was hardest hit, losing a whopping 71.6% compared to the same month last year.

Within the top 10 importer brands of the True Fleet market, only Citroen (+ 15.1%) and in particular, the Jumpy (+ 45.5%) scored points with the fleet managers. In a weak market environment, only the Ford Ranger (+ 9.1%) from among the top 15 fleet models was also able to generate growth compared to the same month last year.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe. In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Junior Marketing Manager

Telefon: +49 (69) 95930-353

Fax: +49 (69) 95930-333

E-Mail: claudia.articek@dataforce.de

Telefon: +49 (69) 95930-265

Fax: +49 (69) 95930-333

E-Mail: christian.spahn@dataforce.de

![]()