The long-term development of physical copper is worth a look. At the beginning of the century, a ton of copper cost around 2,000 US dollars. Today, it costs almost 10,000 US dollars. In January and February 2024, the price was sometimes around USD 7,500 per tonne, but then rose. The major US bank Goldman Sachs, for example, expects commodity prices to rise this year. A similar dynamic could develop for copper as for uranium. Copper could become scarce. Around 700 billion tons of copper have been mined to date.

From today until 2050, twice as much would have to be mined. And the demand for copper is growing and supply problems appear to be looming. This mainly concerns ore grades, which are declining. In addition, there is social unrest in many parts of the world where copper is mined, for example in South America. After silver, copper is the metal with the highest conductivity, and it is cheaper than silver. Today, clean energy technologies consume around 22 percent of copper – including solar energy, wind energy and electric vehicles – and the trend is rising.

This is because the demand for electricity will continue to rise, by an estimated 85 percent by 2050 according to the International Energy Agency. The electronics and real estate sectors also consume the reddish metal. The global demand for electricity also affects power grids, many of which need to be massively modernized. The western world and developing countries are therefore dependent on copper. Due to this development, investors should also look at mining companies that have copper in their projects. These include GoldMining and Aurania Resources, for example.

GoldMining – https://www.commodity-tv.com/ondemand/companies/profil/goldmining-inc/ – owns gold and gold-copper properties in North and South America and one of the largest gold resources in the world.

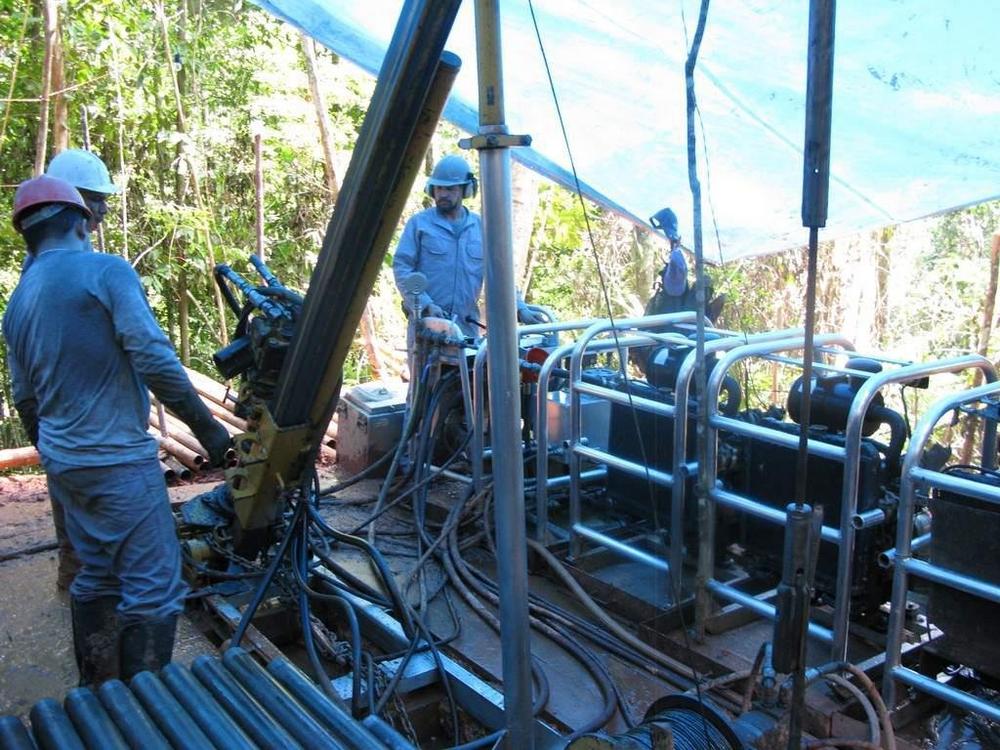

Aurania Resources – https://www.commodity-tv.com/ondemand/companies/profil/aurania-resources-ltd/ – owns the promising The Lost Cities Cutucu project in Ecuador. It contains gold and copper.

Latest corporate information and press releases from Aurania Resources (- https://www.resource-capital.ch/en/companies/aurania-resources-ltd/ -) and GoldMining (- https://www.resource-capital.ch/en/companies/goldmining-inc/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()