Initially, the gold will be processed by small-scale and artisanal mines. Then the Royal Ghana Gold Refinery will acquire licenses to process from large-scale mines. The refinery was established through a partnership between Rosy Royal Minerals of India and the Central Bank of Ghana, which holds a 20% stake in the refinery. Ghana’s government now hopes to curb gold smuggling. National revenues from the precious metal should also be increased. At the same time, this will also create jobs.

Around 40 percent of the world’s refining capacity is located in Switzerland. The fact that Switzerland has such an important position in the gold trade has its roots in the 19th century, when several gold refineries were founded in Switzerland. Even though there are no gold mines in the country, the Swiss National Bank has considerable gold reserves and Switzerland is the center of the gold trade. Gold is not only highly prized by many governments, private investors should also not do without a certain amount of gold or stock up on solid values from gold companies such as Revival Gold or Chesapeake Gold.

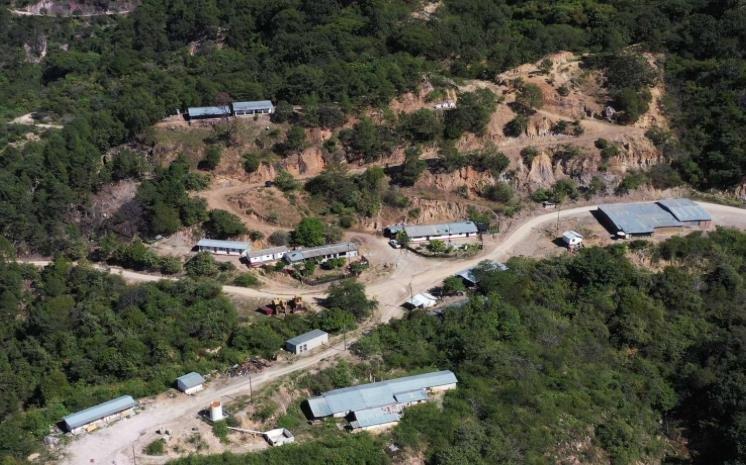

Revival Gold – https://www.commodity-tv.com/play/revival-gold-insight-into-the-strategy-to-bring-two-gold-projects-in-the-usa-to-production/ – has the largest formerly producing gold mine in Idaho, exploration work is underway. The company is also working on the Mercur gold project in Utah. The exploration and development program there is also making good progress.

Chesapeake Gold – https://www.commodity-tv.com/play/mining-news-with-calibre-mining-chesapeake-gold-and-meridian-mining/ – owns gold and silver in its Metates project in Mexico. At another project, the Lucy project, also located in Mexico, up to 5.2 grams of gold per tonne of rock have just been identified in drilling.

In accordance with §34 WpHG, I would like to point out that partners, authors and employees may hold shares in the companies mentioned and that there is therefore a possible conflict of interest. No guarantee for the translation into German. Only the English version of this news is valid.

Disclaimer: The information provided does not constitute a recommendation or advice. The risks involved in securities trading are expressly pointed out. No liability can be accepted for damages arising from the use of this blog. I would like to point out that shares and in particular warrant investments are always associated with risk. The total loss of the capital invested cannot be ruled out. All information and sources are carefully researched. However, no guarantee is given for the correctness of all content. Despite the utmost care, I expressly reserve the right to make errors, particularly with regard to figures and prices. The information contained herein comes from sources that are considered reliable, but in no way claims to be accurate or complete. Due to court rulings, the contents of linked external pages are also to be answered for (e.g. Hamburg Regional Court, in the ruling of May 12, 1998 – 312 O 85/98), as long as no explicit dissociation from these is made. Despite careful control of the content, I assume no liability for the content of linked external sites. The respective operators are solely responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/….

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()