Highlights:

- 18.6 m @ 4.1 g/t AuEq intersected in SDDSC055 60 m above, 40m east and in the plane of Rising Sun shoot, previously drilled in SDDSC050 which intersected 305.8 m @ 2.4 g/t AuEq (refer news 14 December, 2022).

o Rising Sun shoot continuity now defined over 250 m down dip across 5 drill holes, and shows potential for thickening or bulging of the host structure at depth.

- SDDSC055 demonstrated significant scale, grade and continuity of mineralization around SDDSC050. Better results from SDDSC055 included:

o 18.6 m @ 4.1 g/t AuEq (1.2 g/t Au, 1.8 %Sb) from 388.5 m

§ including 0.9 m @ 25.0 g/t AuEq (4.1 g/t Au, 13.2 %Sb) from 388.5 m

§ including 0.4 m @ 59.3 g/t AuEq (9.8 g/t Au, 31.4 %Sb) from 392.0 m

§ including 2.1 m @ 11.5 g/t AuEq (4.7 g/t Au, 4.3 %Sb) from 400.4 m

§ including 0.3 m @ 8.3 g/t AuEq (5.1 g/t Au, 2.0 %Sb) from 405.9 mo 5.1 m @ 2.8 g/t AuEq (1.7 g/t Au, 0.7 %Sb) from 417.9 m

§ including 0.2 m @ 26.8 g/t AuEq (12.6 g/t Au, 9.0 %Sb) from 417.9 m

§ including 0.6 m @ 10.4 g/t AuEq (7.9 g/t Au, 1.6 %Sb) from 420.8 m - Lower grade margin of three further vein sets intersected in SDDSC053, parallel and 140 m above SDDSC050, skimming and exiting the host position. Better results included: o 10.4 m @ 1.5 g/t AuEq (0.7 g/t Au, 0.5 %Sb) from 270.6 m o 14.0 m @ 1.5 g/t AuEq (0.9 g/t Au, 0.4 %Sb) from 307.0 m § including 0.4 m @ 35.9 g/t AuEq (18.0 g/t Au, 11.4 %Sb) from 317.5 m o 11.0 m @ 1.0 g/t AuEq (0.6 g/t Au, 0.3 %Sb) from 400.5 m

- Drilling with three rigs is in progress at Sunday Creek, with 13 holes being processed and analysed or in progress (Figure 2). Pending holes include the deepest drilled on the project.

- Mawson owns 51% of SXG, valuing its stake at A$59 million (C$54 million) based on SXG’s closing price on February 27, 2022.

Ivan Fairhall, Mawson CEO, states: “Another strong hole at Sunday Creek, with grade, width and continuity firming up at Rising Sun. This latest 18.6 m at 4.1 g/t AuEq intercept ties in with 5 others over a 250 m plunge that bulges at depth, boding well for scale and potential mineability.

Southern Cross continues to drill aggressively, with over A$17.5 million cash, 3 rigs and 30,000 metres targeted for 2023. There are 13 holes being drilled or analyzed, so Mawson shareholders benefit from exposure to considerable SXG exploration news flow, in addition to significant exploration potential at Mawson’s Skellefteå earn-in in Sweden, and the 100% owned 1Moz AuEq Rajapalot project in Finland.”

Results Discussion

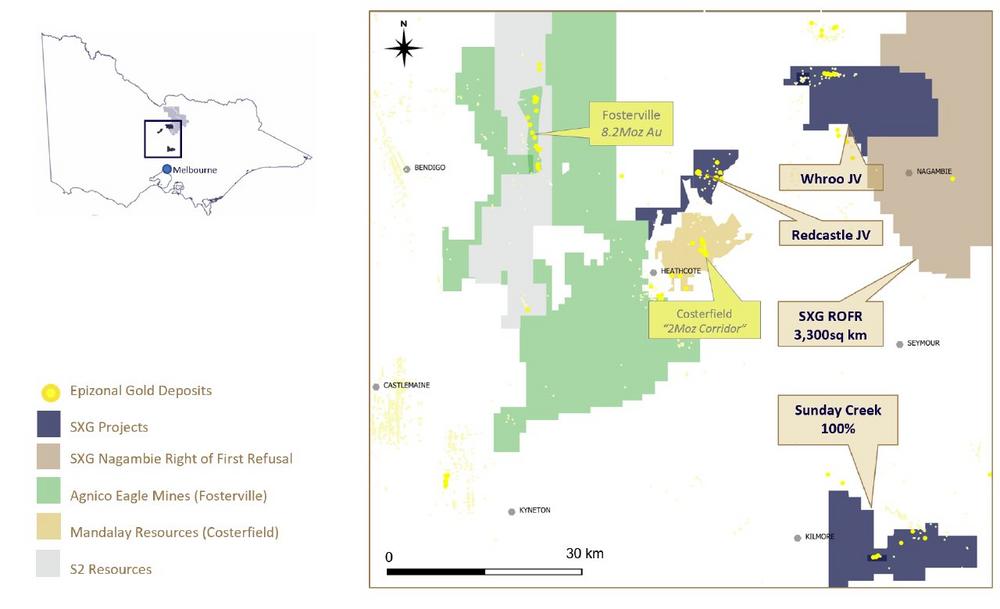

The Sunday Creek epizonal-style gold project is located 60 km north of Melbourne within 19,365 hectares of granted exploration tenements. SXG is also the freehold landholder of 133 hectares that forms the key portion in and around the drilled area at the Sunday Creek Project.

Sunday Creek has a 10 km mineralized trend that extends beyond the drill area and is defined by historic workings and soil sampling which have yet to receive any exploration drilling and offers potential future upside.

Drill hole SDDSC055 designed as a cross hole drilled from the NE to SW across the upper levels of SDDSC050 and 90 m below MDDSC021 (21.7 m @ 6.2 g/t AuEq (4.7g/t Au, 1.0% Sb) from 274.7 m). This is the first of six NE-SW oriented drillholes that are to be drilled across the trace of SDDSC050 from 400 m to 800 m to constrain the position of the host breccia dyke which will allow deeper drilling in an east-west direction below SDDSC050 to be better targeted. The hole intersected mineralization up to 60 m above and 40 m east of SDDSC050 in the plane of the Rising Sun structure, highlighting the undulating nature of the dyke host rock, suggesting a thickening or bulging of the host structure at depth. Also noted are the high antimony grades, up to 31.4% Sb, encountered.

Drill hole SDDSC053, designed as a 150 m up-dip hole from SDDSC050 at Rising Sun 100 m up dip from SDSSC055. The hole intersected the lower grade margin of three veins sets (Figures 2-4). The hole was drilled too far north of the Rising Sun shoot and only tested the northern margins of the host breccia dyke and exited the host position as a consequence.

Drillholes SDDSC053 and SDDSC055 define continuity in the Rising Sun shoot over 250 m down dip (Figure 4) between the upper levels of drillholes SDDSC050, MDDSC021 (21.7 m @ 6.2 g/t AuEq (4.7g/t Au, 1.0% Sb)) and SDDSC046 (21.5 m @ 15.0 g/t AuEq (12.2 g/t Au and 1.7% Sb)).

SDDSC054, considered to be a near-miss hole as defined by geochemical (arsenic) and alteration (sericite-pyrite) vectors, is located 25 m east of SDDSC052 at Apollo. The hole interested thin and low-grade mineralization on the most easterly extents of the Apollo area drilled to date. Better intercepts included 1.6 m @ 3.1 g/t AuEq (2.4 g/t Au, 0.4 %Sb) from 140.0 m, and 0.7 m @ 2.1 g/t AuEq (2.1 g/t Au, 0.0 %Sb) from 207.0 m.

Further discussion and analysis of the Sunday Creek project by Southern Cross Gold is available on the SXG website www.southerncrossgold.com.au.

Figures 1-3 show project location and plan and longitudinal views of drill results reported here and Tables 1–3 provide collar and assay data. The true thickness of the mineralized interval is interpreted to be approximately 60% – 70% of the sampled thickness. Lower grades were cut at 0.3 g/t lower cutoff over a maximum of 3 m with higher grades cut at 5.0 g/t AuEq cutoff over a maximum of 1 m.

Update on Current Drilling

Drilling with three rigs is in progress at Sunday Creek at the Golden Dyke, Rising Sun and Apollo prospects. 10 holes (SDDSC56-63/65/66) are being geologically processed and analyzed, with three holes (SDDSC064/67/68) in drill progress (Figure 2) with continual news flow expected. Drill holes awaiting assays or in progress include the deepest drill holes drilled on the project at Rising Sun (SDDSC061/67) and Apollo (SDDSC066).

Technical Background and Qualified Person

The Qualified Person, Michael Hudson, Executive Chairman and a director of Mawson Gold, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed, verified and approved the technical contents of this release.

Analytical samples are transported to the Bendigo facility of On Site Laboratory Services (“On Site”) which operates under both an ISO 9001 and NATA quality systems. Samples were prepared and analyzed for gold using the fire assay technique (PE01S method; 25 gram charge), followed by measuring the gold in solution with flame AAS equipment. Samples for multi-element analysis (BM011 and over-range methods as required) use aqua regia digestion and ICP-MS analysis. The QA/QC program of Southern Cross Gold consists of the systematic insertion of certified standards of known gold content, blanks within interpreted mineralized rock and quarter core duplicates. In addition, On Site inserts blanks and standards into the analytical process.

Gold equivalent “AuEq” for Sunday Creek is = Au (g/t) + 1.58 × Sb (%) based on assumed prices of gold US$1,700/oz Au and antimony US$8,500/metal tonne, and total year metal recoveries of 93% for gold and 95% for antimony. Given the geological similarities of the projects, this formula has been adopted to align to TSX listed Mandalay Resources Ltd Technical Report dated 25 March 2022 on its Costerfield project, which is located 54 km from Sunday Creek and which historically processed mineralization from the property.

For previously reported exploration results referenced in this news release, refer to the following:

October 27, 2021 MDDSC021

December 13, 2021 MDDSC025

March 8, 2022 MDDSC026

May 30, 2022 SDDSC033

August 9, 2022 SDDSC 039

October 4, 2022 SDDSC046

November 2, 2022 SDDSC049

December 14, 2022 SDDSC050

Gold equivalent “AuEq” for Rajapalot is AuEq = Au x 95% + Co x 87.6% / 911 based on updated assumed commodity prices of Co USD27.22/lb and Au USD1,700/oz, and includes recovery factors for Au (95%) and Co (87.6%). Refer to Mawson’s Technical Report: NI 43-101 Technical Report on a Preliminary Economic Assessment of the Rajapalot Gold-Cobalt Project, Finland, which may be found under the Company’s profile on SEDAR. The PEA is preliminary in nature and includes resources are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves, and there is no certainty that the PEA results will be realized. Mineral resources are not mineral reserves and do not have demonstrated economic viability.

About Mawson Gold Limited (TSX:MAW, FRANKFURT:MXR, OTCPINK:MWSNF)

Mawson Gold Limited is an exploration and development company. Mawson has distinguished itself as a leading Nordic exploration company with its 100% owned flagship Rajapalot gold-cobalt project in Finland, and right to earn into the Skellefteå North gold project in Sweden. Mawson also currently owns 51% of Southern Cross Gold Ltd (ASX:SXG) which in turn owns or controls three high-grade, historic epizonal goldfields covering 470 km2 in Victoria, Australia.

About Southern Cross Gold Ltd (ASX:SXG)

[email=https://www.southerncrossgold.com.au/]Southern Cross Gold[/email] holds the 100%-owned Sunday Creek project in Victoria and Mt Isa project in Queensland, the Redcastle and Whroo joint ventures in Victoria, Australia, and a strategic 10% holding in ASX-listed Nagambie Resources Limited (ASX:NAG) which grants SXG a Right of First Refusal over a 3,300 square kilometer tenement package held by NAG in Victoria.

On behalf of the Board,

"Ivan Fairhall"

Ivan Fairhall, CEO

Further Information

www.mawsongold.com

1305 – 1090 West Georgia St., Vancouver, BC, V6E 3V7

Mariana Bermudez (Canada), Corporate Secretary

+1 (604) 685 9316 info@mawsongold.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Forward-Looking Statement

This news release contains forward-looking statements or forward-looking information within the meaning of applicable securities laws (collectively, "forward-looking statements"). All statements herein, other than statements of historical fact, are forward-looking statements. Although Mawson believes that such statements are reasonable, it can give no assurance that such expectations will prove to be correct. Forward-looking statements are typically identified by words such as: believe, expect, anticipate, intend, estimate, postulate, and similar expressions, or are those, which, by their nature, refer to future events. Mawson cautions investors that any forward-looking statements are not guarantees of future results or performance, and that actual results may differ materially from those in forward-looking statements as a result of various factors, including, Mawson’s expectations regarding its ownership interest in Southern Cross Gold, capital and other costs varying significantly from estimates, changes in world metal markets, changes in equity markets, the potential impact of epidemics, pandemics or other public health crises, including the current pandemic known as COVID-19 on the Company’s business, risks related to negative publicity with respect to the Company or the mining industry in general; exploration potential being conceptual in nature, there being insufficient exploration to define a mineral resource on the Australian-projects owned by SXG, and uncertainty if further exploration will result in the determination of a mineral resource; planned drill programs and results varying from expectations, delays in obtaining results, equipment failure, unexpected geological conditions, local community relations, dealings with non-governmental organizations, delays in operations due to permit grants, environmental and safety risks, and other risks and uncertainties disclosed under the heading "Risk Factors" in Mawson’s most recent Annual Information Form filed on www.sedar.com. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, Mawson disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()