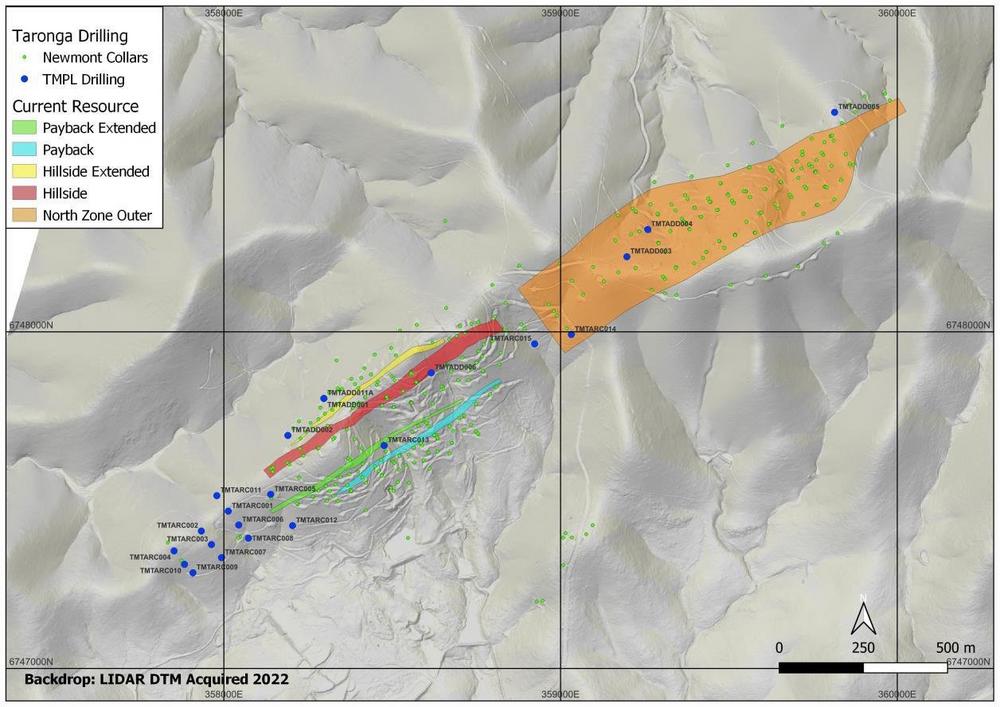

Four lines of reverse circulation (RC) drilling have been completed at approximately 100m spacing, as shown on Figure 1. In addition, 8 diamond drillholes and an additional RC hole have been completed as twins of the drilling, previously undertaken by Newmont (Figure 1).

Results have been returned for all of the SW extension drillholes with the following intercepts (Table 1):

Results of the twin drilling are still being collated and will be reported when complete. The results have so far not identified any significant divergence to the historical Newmont data.

Based on the above results, and a review of the previous Newmont drilling data, a revised interpretation of the mineralisation has been made that suggests the SW extension is a continuation of the Payback Extended zone of mineralisation (Figure 2).

Based on this new interpretation, the Company will now embark on an increased drilling programme of approximately 5,500m RC drilling designed to enable conversion of the SW extension into indicated resource status.

This drill programme is also designed to fill in the gaps in the current drilling between the previously interpreted North Zone and South Zone (Newmont Interpretation) and to improve drill density in several areas where it is likely that Inferred resources could be converted to indicated status within the current resource area.

This programme is shown in Figure 3, along with the previous Newmont pit designs and is due to commence in February 2023.

First Tin CEO Thomas Buenger commented, “It is very pleasing that these drilling results have proven the existence of significant tin mineralisation, confirming our interpretation that the Taronga tin deposit remains open to the SW.

“In addition, our geologists’ revised interpretation of all the historical data suggests excellent potential to prove that the two mineralised areas, identified as the North and South Zones by Newmont in the early 1980s, are in fact continuous.

“The opportunity to create additional value at Taronga remains very strong indeed. We believe that the mineralisation in the NE is also open and we plan to test several areas which are within the confines of the pits proposed by Newmont with shallow RC drilling. Given the positive nature of these drill results, we plan to fast-track this drilling in order to establish the extent of mineralisation within the immediate Taronga project area. We expect that this will only add a short period of time to the feasibility study schedule and should lead to enhanced economics. The feasibility study remains on track to be completed by the end of 2023.”

“With a range of workstreams ongoing and planned at Taronga, we have kicked off the year with a significant array of activity, and are excited to update shareholders in due course.”

Enquiries:

First Tin Via SEC Newgate belowThomas Buenger – Chief Executive Officer

Arlington Group Asset Management Limited (Financial Advisor and Joint Broker)

Simon Catt 020 7389 5016

WH Ireland Limited (Joint Broker)

Harry Ansell 020 7220 1670

SEC Newgate (Financial Communications)

Elisabeth Cowell / Axaule Shukanayeva /Molly Gretton 07900 248 213

Notes to Editors

First Tin is an ethical, reliable, and sustainable tin production company led by a team of renowned tin specialists. The Company is focused on becoming a tin supplier in conflict-free, low political risk jurisdictions through the rapid development of high value, low capex tin assets in Germany and Australia.

Tin is a critical metal, vital in any plan to decarbonise and electrify the world, yet Europe has very little supply. Rising demand, together with shortages, is expected to lead tin to experience sustained deficit markets for the foreseeable future. Its assets have been de-risked significantly, with extensive work undertaken to date.

First Tin’s goal is to use best-in-class environmental standards to bring two tin mines into production in three years, providing provenance of supply to support the current global clean energy and technological revolutions.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

Telefon: +41 (71) 354-8501

E-Mail: mo@resource-capital.ch

![]()