The Fed is tightening monetary policy, but certainly not excessively. This increases the chances of stagflation and a rising gold price.

Many believe that central banks are raising interest rates too much, the Fed is slowing down too much, and inflation is falling. Certainly, inflation will fall because the money supply will grow more slowly. The effects occur with a lag, hence the assumption that central banks may exaggerate. However, the fact that experts at the Fed and other central banks are aware of the lagged effects speaks against possible exaggerations. Nevertheless, there is still an excess of money supply relative to output. The increase in the money supply peaked during the pandemic. So, inflation is not going to go away anytime soon, because what matters for inflation is the development of the money supply.

Real interest rates are probably not high enough to slow nominal growth. Real interest rates are what an investor receives adjusted for inflation. It will be difficult to achieve the central banks‘ inflation expectations of around two percent without real positive interest rates. Falling nominal interest rates, i.e. interest that accrues without factoring in inflation, existed even before the pandemic. This has fueled inflation and made real yields more and more negative. What all this means for the price of gold is that the Fed is actually still running a loose monetary policy. And as long as real interest rates are still strongly negative, investors lack incentives to save and thus lack capital for investment and sustainable growth. Moreover, if inflation cannot be reduced significantly, then recession looms even more likely stagflation (economic stagflation and high inflation). This is an absolutely supporting factor for the gold price, so get into gold stocks!

There is Tudor Gold – https://www.youtube.com/watch?v=pRG-xDdJ_z0 – with its very promising Treaty Creek gold project in British Columbia as well as other precious metal and base metal projects.

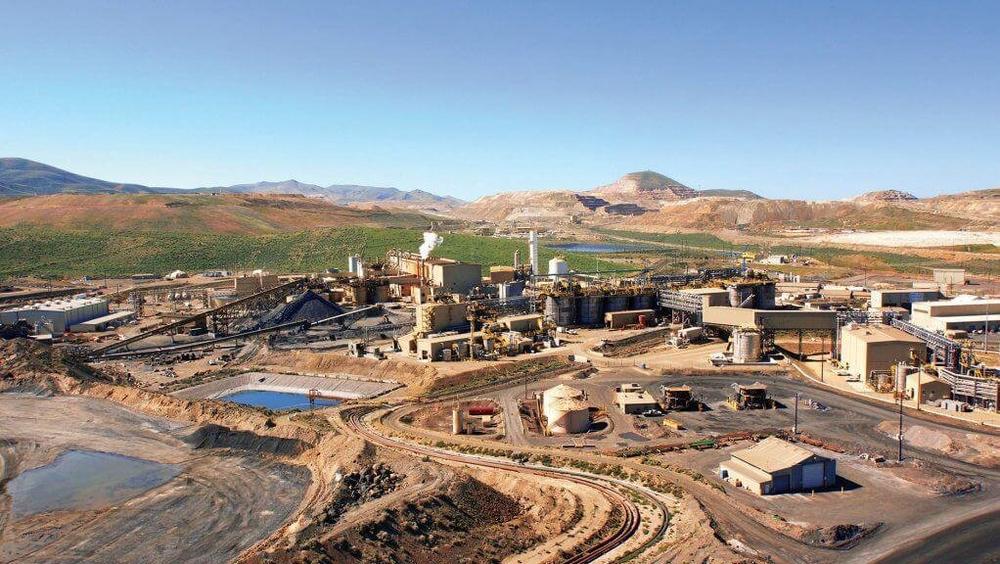

Investors seeking diversification should look at Gold Royalty – https://www.youtube.com/watch?v=DfO7n5VEP_E -. With a focus on North and South America, Gold Royalty recently acquired the Nevada Gold Mines royalty portfolio.

Latest corporate information and press releases from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()