Key Highlights:

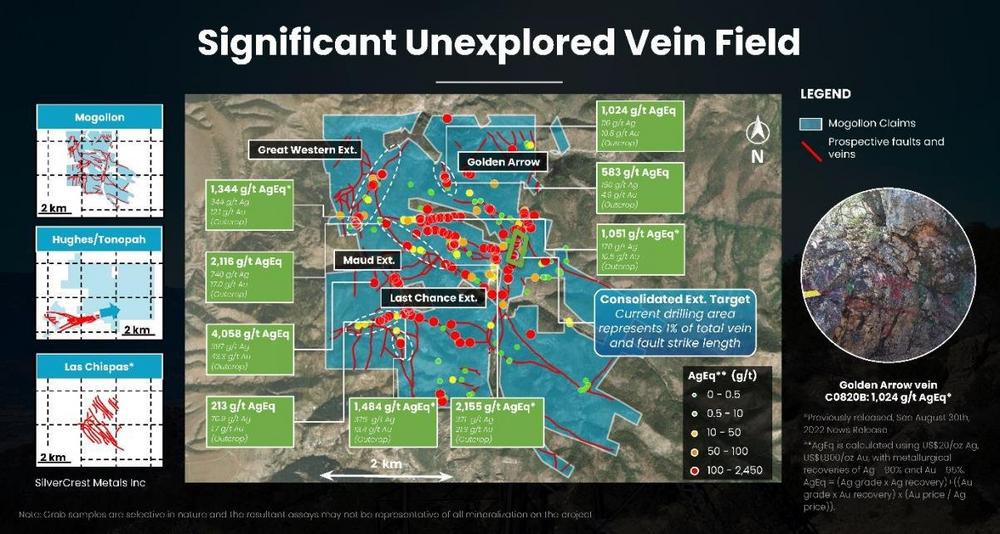

- There are Significant Extensions to High-Grade Veins: Rock sampling shows that high-grade mineralization exists in new areas not previously prospected in modern times (see attached figure).

- Great Western Vein: Samples of this vein returned up to 4,058 g/t silver equivalent* (397 g/t Ag and 43.3 g/t Au) and it now has a known strike length of 2 km.

- Maud South Vein: Samples of this vein returned up to 2,116 g/t silver equivalent (740 g/t Ag and 17 g/t Au) and it has it now has a known strike length of 1.5 km.

- Golden Arrow Vein: Samples of this vein returned up to 1,024 g/t silver equivalent (116 g/t Ag and 10.8 g/t Au) and it now has a known strike length of 475 m.

- Last Chance Vein: Samples of this vein returned up to 213 g/t silver equivalent (71 g/t Ag and 1.7 g/t Au) and it now has a known strike length of 2.7 km.

- There are Multiple Targets that Remain Unexplored: None of these new areas have ever been drill tested.

- Drilling is Underway at the Consolidated Mine: The first hole of the season intersected the Queen Vein over 15 m and featured visible silver sulfide mineralization 75 m down-dip from hole MOG22-05.

* Silver equivalent is calculated using US$20/oz Ag, US$1,800/oz Au, with metallurgical recoveries of Ag – 90% and Au – 95%. AgEq = (Ag grade x Ag recovery)+((Au grade x Au recovery) x (Au price / Ag price)).

Galen McNamara, CEO, stated: “As our early assessment of the Mogollon project continues, we are developing new targets across the district. There are now roughly 50 km of prospective veins and structures to prioritize, most of which are underexplored or unexplored, and many of which have returned high-grade assay results from outcropping veins at surface. Additionally, we are currently drilling a known high-grade zone where the mineralization remains open to expansion.”

Vein Descriptions

The Company has compiled a geochemical database of over 100 rock samples collected from areas covering the extensions of multiple high-grade, fault-controlled silver and gold-bearing epithermal-related veins. The structurally controlled veins and vein-breccias are dominantly comprised of quartz with lesser calcite and minor adularia, fluorite and barite locally mineralized with argentite and base metal sulfides. The faults and associated veins are predominantly east-west striking (e.g., Last Chance, Maud) or north-south striking (e.g., Great Western, Golden Arrow) and are locally exposed over their known km-scale strike length in historical prospect pits. The compiled assay data highlight numerous new target areas:

- Golden Arrow Vein: The north-striking Golden Arrow vein has been sampled in historical prospect pits along 200m of its 475m strike length on the project. The epithermal-related vein is quartz dominant with brecciated margins and is mineralized along its strike length with channel and grab samples returning grades of up to 1,024 g/t silver equivalent (116 g/t Ag, 10.8 g/t Au). This vein has not been drill-tested and represents a priority target for additional sampling and mapping.

- Last Chance Vein: The predominantly east-striking, high-grade Last Chance vein has a mapped strike-length of over 2.1 km where grab and channel samples along the western extension of the vein have returned grades of up to 1,484 g/t silver equivalent (376 g/t Ag, 13.4 g/t Au) and up to 213 g/t silver equivalent (70.9 g/t Ag, 1.7 g/t Au). The extension covers over 500m of strike with numerous mapped intersections with north-striking veins. Further mapping and sampling are required to fully evaluate the potential of the vein, especially near the vein-intersections where higher-grade ore shoots may be located.

- Maud South Vein: The extension of the northwest striking Maud South Vein covers an additional 1 km of strike-length. The vein has now been traced for over 1.5 km on the project. Sampling along the extension of the vein in historical prospect pits has returned grades of up to 2,116 g/t silver equivalent (740 g/t Ag, 17 g/t Au). The Maud South vein remains completely undrilled and represents a significant opportunity to define multiple new drill targets along its km-scale strike-length.

- Great Western Vein: The north to northeast-trending Great Western vein system with associated faulted offsets has been traced for an additional 500 m and now has a known cumulative strike length of 2 km on the project. Samples of veins from historical prospect pits and trenches returned high-grade results such as 4,058 g/t silver equivalent (397 g/t Ag, 43.3 g/t Au). The Great Western vein system has never been drill-tested and represents a structurally complex area potentially host to multiple new drill targets.

Analytical and Quality Assurance and Quality Control Procedures

Rock samples were either sent to Paragon Geochemical Laboratories (“Paragon”) in Sparks, Nevada or Skyline Assayers and Laboratories (“Skyline”) in Tucson, Arizona for preparation and analysis. Paragon and Skyline demonstrate compliance with ISO/IEC Standard 17025:2017 for analytical procedures. At both labs, samples were prepared using industry standard drying, crushing, pulverising and sieving methods. At both labs, samples were analyzed for gold via fire assay with an AA (atomic absorption) finish (Au-AA30 Paragon or FA-01 Skyline) and silver via atomic emission spectroscopy after four-acid digestion at Paragon (AgMA-AAS) and via inductively coupled plasma-mass spectrometry (ICP-MS) after an aqua regia digestion at Skyline (TE-3). Samples that assayed over 5 ppm Au at Paragon were rerun via fire assay with a gravimetric finish (Au-GR30) and samples that assayed over 3 ppm Au at Skyline were rerun via fire assay with a gravimetric finish (FA-02). Samples that assayed over 200 ppm Ag at Paragon or 150 ppm Ag at Skyline were rerun via fire assay for Ag with a gravimetric finish (Ag-GRAA30 or FA-04). Paragon and Skyline insert reference standards, duplicates, and blank samples in each batch of samples with standard internal QA-QC procedures, which all returned results within acceptable levels.

Marketing Services Agreement

Summa Silver has extended an agreement with Blossom Social Inc. (“Blossom”) effective on October 6, 2022 for the provision of various corporate communications services. Pursuant to the agreement, Blossom will provide sponsored lessons to users of Blossom’s platform containing informational content about the Company. The Company has agreed to pay to Blossom up to a total of CAD $3,000 for the provision of the services. The Company and Blossom act at arm’s length, and, to the knowledge of the Company, Blossom has no interest, direct or indirect, in the Company or its securities or any right or intent to acquire such an interest.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company owns a 100% interest in the Hughes property located in central Nevada and has an option to earn 100% interest in the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The Mogollon property is the largest historic silver producer in New Mexico. Both properties have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the release of assays; the exploration and development of the Company’s mineral exploration projects including completion of surveys and drilling activities.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; the ongoing conflict in Ukraine; and other related risks and uncertainties disclosed in the Company’s public disclosure documents.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

orporate Development and Investor Relations

Telefon: +1 (604) 288-8004

E-Mail: giordy@summasilver.com

CEO & Director

E-Mail: info@summasilver.com

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()