Highlights

- Golden Rim has received results for ground magnetic, gradient-array Induced Polarisation (IP) and pole-dipole IP geophysical surveys at Kada, covering both the Massan and Bereko prospects.

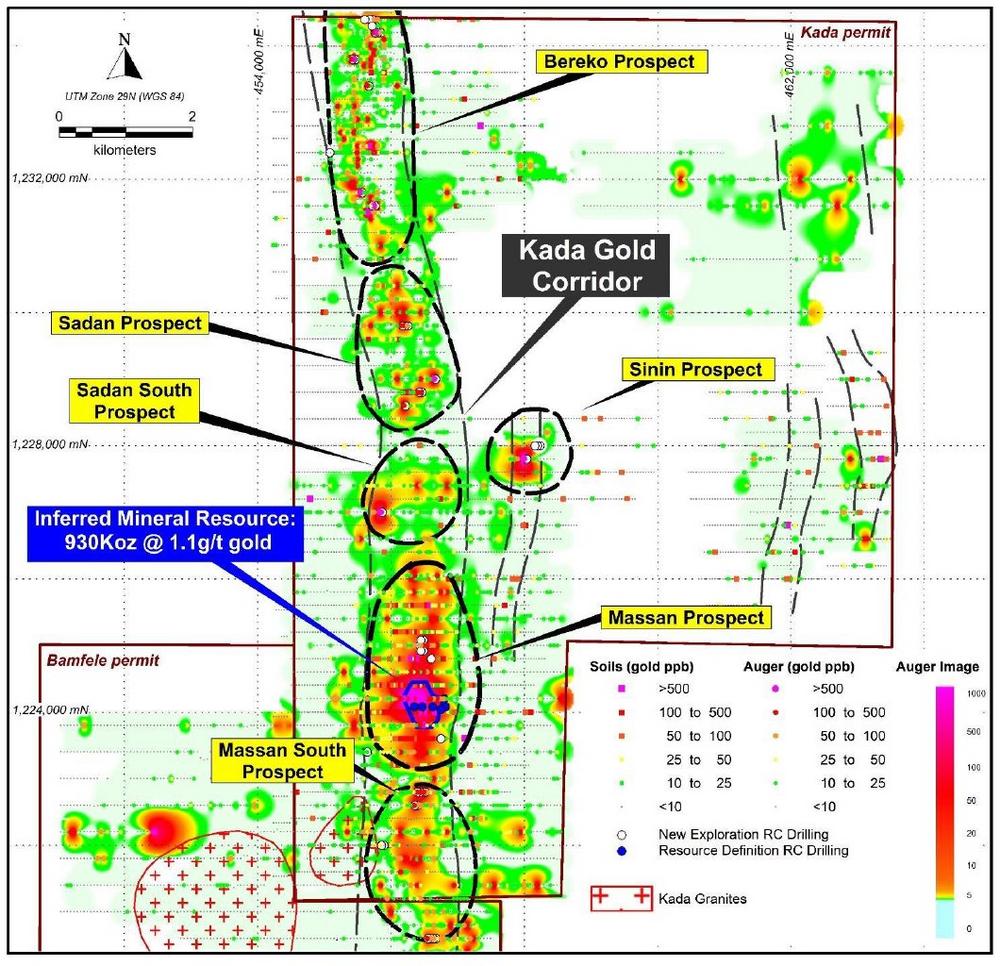

- Surveys identify multiple new drill targets for gold mineralisation outside Golden Rim’s 930,000oz[1] gold maiden Inferred Mineral Resource Estimate (MRE) area at Massan.

- Highest priority targets associated with the margin areas between highly resistive and chargeable IP anomalies and highly conductive and chargeable IP anomalies.

- The widest and highest-grade mineralisation within the MRE area at Massan generally occurs proximal to these margin areas.

- A priority target for the follow-up drilling is a strong untested IP anomaly that lies directly below the previous drill intersection of 29m @ 8.5g/t gold in KRC025 in the MRE.

- Golden Rim will test new targets in its upcoming drill program, scheduled to begin in Q4 2022.

- Infill drilling at Massan planned to enable Golden Rim to covert its Inferred MRE to Indicated category.

Managing Director Craig Mackay said:

“This geophysical survey data for Kada has helped our exploration team further understand the nature of mineralisation in the region and when integrated with our auger geochemical data, we generated multiple exciting new gold targets for the upcoming drilling program.

“We expect to recommence both RC and diamond drilling in Q4 2022. We will aggressively drill the Bereko prospect, as well as conduct resource extension around the maiden MRE at the Massan prospect.

“In addition, we intend to undertake infill drilling to convert a large portion of our MRE to indicated, which will lead into a scoping study in 2023.”

Geophysical Surveys

Golden Rim contracted SAGAX to complete ground magnetic (82km), gradient-array IP (75km) and pole-dipole IP (6.6km) surveys at Kada, focused on the Bereko and Massan prospects (Figures 1 & 2). The surveys were designed to enhance Golden Rim’s understanding of the structural controls and distribution of the gold mineralisation.

Magnetic and gradient-array IP lines were spaced at 100m, with a 25m station spacing along the lines.

The shallow, ferruginous lateritic unit that covers the majority of Kada tends to obscure the magnetic signal of the underlying bedrock, however IP data has been immediately beneficial for increasing understanding of structural controls in the bedrock and identifying new drill targets in both Massan and Bereko prospects, discussed separately below.

Massan Prospect

The gradient-array IP survey showed two parallel, north-south trending chargeability highs that extend for 1km across the MRE area at Massan, and then extend a further 1km south of the MRE area. The westernmost chargeability high is spatially associated with some of the highest-grade gold and broadest mineralisation in the MRE area. To better understand this relationship, four east-west pole-dipole lines were completed across Massan (Figure 2). Two of these lines are in within the MRE area, and the other two lines are south of the MRE area across the width of the high-chargeability area.

Analysis shows that most of the encountered gold mineralisation is associated with elevated levels of chargeability of varying amplitudes related to areas of stronger sulphide mineralisation, as well as conductive anomalies, which are associated with thicker areas of clay related to deeper zones of weathering.

Gold mineralisation is often found near the margin between a wide, highly resistive and chargeable domain on the western side, and a highly conductive and chargeable domain on the eastern side. The widest and highest-grade mineralisation within the MRE area generally occurs proximal to these boundaries (Figure 3). This insight, coupled with auger drilling gold results, has allowed Golden Rim to further refine regional drilling targets along the Kada Gold Corridor at both Massan and Bereko.

Analysis in section using the pole-dipole IP data has also identified new drilling targets proximal to the MRE area. The pole-dipole lines within the MRE area (lines 1,224,040m and 1,224,200m North) demonstrated that areas of high chargeability (>15mV/V) adjacent to the oxide-transition boundary or the base of complete oxidation (BOCO) often contain significant gold intersections (Figures 4 and 5), including:

- KRC025 – 29m @ 8.5g/t gold

- KRC018 – 20m @ 1.6g/t gold

- KRC011 – 16m @ 2.1g/t gold

- KDH007 – 20m @ 1.1g/t gold

- KRC023R – 9m @ 2.2g/t gold (to End of Hole)

- KRC019 – 23m @ 1.2g/t gold

A priority target for the follow-up drilling is a strong untested IP chargeability high anomaly that lies directly below the high-grade intersection of 29m @ 8.5g/t gold in previous drill hole KRC025 and beneath the current MRE pit shell (Figure 4).

There is an untested chargeability high that occurs on the oxide-transition boundary just 150m west of KRC025, which has had no drilling to date (Figure 4). This target is also located outside the MRE pit shell and represents an opportunity to add additional ounces to the gold inventory at Kada.

There are multiple instances of elevated chargeability values occurring proximal to the BOCO on the most southern pole-dipole line, over 500m south of the current MRE extent. This area is >200m from any drilling and provides numerous new drill targets, and an opportunity for further resource extension and potential satellite gold deposits.

Bereko Prospect

In Bereko, magnetic and IP data indicate there are NW-SE trending faults that correlate to breaks within the main N-S trending auger anomalies (Figure 6). Mineralisation generally occurs in areas of high chargeability as seen at Massan, but north of the faulting this relationship is less clear.

IP data has helped to identify multiple additional drill targets for investigation at Bereko, targeting high chargeability areas adjacent to a transition between high conductivity and high resistivity where there are broad bedrock gold anomalies (Figure 7).

Current Progress & Next Steps

Golden Rim’s next drilling at Kada is scheduled to commence in November 2022.

At Massan, there are two drilling programs are planned. The first is a resource extension RC program, focused on following up open intersections at the margins of the MRE (below KRC025 – 29m @ 8.5g/t gold), as well as on the open mineralisation to the north (KRC072 – 66m @ 1.0g/t gold).

The second and largest program is an infill diamond and RC drilling program targeting the highest grade and deepest oxide portion of the MRE, with the aim of converting a large proportion of the existing MRE from Inferred to Indicated category. In addition to this, 700m of trenching has been scheduled within this area to improve the geological understanding of the orientation and controls on the gold mineralisation (Figure 8).

At Bereko, Golden Rim plans to complete RC and diamond drilling to follow up on gold intersections obtained in the maiden RC drilling (11m @ 6.3g/t gold, 10m @ 5.6g/t gold, 27m @ 1.2g/t gold), and additional targets identified from recent auger drilling and the IP geophysical data.

Contact Information:

Golden Rim Resources Ltd

ABN 39 006 710 774

Craig Mackay

Managing Director

+61 3 8677 0829

In Europe:

Swiss Resource Capital AG

Jochen Staiger

This announcement was authorised for release by the Board of Golden Rim Resources Ltd.

Competent Persons Statements

The information in this report relating to previous exploration results and Mineral Resources are extracted from the announcements: Golden Rim identifies additional oxide gold target areas at Bereko dated 14 July 2022; Golden Rim Hits 43m at 1.2gt Gold Outside Kada Mineral Resource dated 21 June 2022; Golden Rim Commences Infill Auger Drilling at Bereko Gold Prospects dated 25 May 2022; Golden Rim hits shallow high-grade oxide gold at Bereko dated 19 May 2022; Golden Rim’s Drilling Outside Kada Mineral Resource Area Delivers More Oxide Gold dated 11 May 2022; Kada Maiden Mineral Resource 930Koz Gold dated 3 March 2022; Golden Rim Discovers More Oxide Gold in Exploration Drilling at Kada dated 1 March 2022; Golden Rim hits 171.5g/t gold in sampling at Kada with multiple new targets identified dated 22 February 2022; Golden Rim Discovers Exciting New Zone of Oxide Gold at Kada – 66m at 1.0g/t Gold dated 17 February 2022; Golden Rim Expands Kada Bedrock Gold Corridor to 15km dated 30 July 2021; Major Bedrock Gold Corridor Extends to 4.7km at Kada dated 20 May 2021; Major 3.5km Bedrock Gold Corridor Confirmed at Kada dated 19 April 2021. These reports are available on the Company’s website (www.goldenrim.com.au). The Company confirms that it is not aware of any new information or data that materially affects the information included in these announcements and, in the case of the Mineral Resource estimate, that all material assumptions and technical parameters underpinning estimate continue to apply and have not materially changed.

The information in this report that relates to exploration results is based on information compiled by Craig Mackay, a Competent Person, who is a Member of the Australasian Institute of Mining and Metallurgy. Mr Mackay is a full-time employee of the Company and has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’. Mr Mackay consents to the inclusion in the report of the matters based on his information in the form and context in which it appears.

Forward Looking Statements

Certain statements in this document are or maybe “forward-looking statements” and represent Golden Rim’s intentions, projections, expectations, or beliefs concerning among other things, future exploration activities. The projections, estimates and beliefs contained in such forward-looking statements necessarily involve known and unknown risks, uncertainties, and other factors, many of which are beyond the control of Golden Rim, and which may cause Golden Rim’s actual performance in future periods to differ materially from any express or implied estimates or projections. Nothing in this document is a promise or representation as to the future. Statements or assumptions in this document as to future matters may prove to be incorrect and differences may be material. Golden Rim does not make any representation or warranty as to the accuracy of such statements or assumptions.

ABOUT GOLDEN RIM RESOURCES

Golden Rim Resources Limited is an ASX listed exploration company with a portfolio of advanced minerals projects in Guinea and Burkina Faso, West Africa and in Chile, South America.

The Company’s flagship project is the advanced Kada Gold Project in eastern Guinea. Guinea remains one of the most under-explored countries in West Africa. Golden Rim has outlined a maiden Inferred Mineral Resource of 25.5Mt at 1.1g/t gold for 930Koz[1], the majority of which is shallow oxide-transitional gold mineralisation. Golden Rim is focussed on growing the Mineral Resource. Most of the 200km2 project area remains poorly explored and there is considerable upside for the discovery of additional oxide gold mineralisation.

The Company discovered and has outlined an Indicated and Inferred Mineral Resource of 50Mt at 1.3g/t gold for 2Moz[2] at the Kouri Gold Project, located in north-east Burkina Faso. Kouri covers 325km2 of highly prospective Birimian greenstones. Exploration has successfully located several high-grade gold shoots.

In northern Chile, Golden Rim has the Paguanta Copper and Silver-Lead-Zinc Project. Historically a silver mine, the Company has outlined a Measured, Indicated and Inferred Mineral Resource of 2.4Mt at 88g/t silver, 5.0% zinc and 1.4% lead for 6.8Moz silver, 265Mlb zinc and 74Mlb lead[3] at the Patricia Prospect. The Mineral Resource remains open.

At the adjacent Loreto Copper Project in Chile, Golden Rim has signed an Option and Joint Venture agreement with Teck Chile whereby Teck Chile can acquire up to a 75% interest in the project.

ASX:GMR

Market Capitalisation: A$13 million

Shares on Issue: 314 million

T + 61 3 8677 0829 | E info@goldenrim.com.au | goldenrim.com.au

[1] ASX Announcement: Kada Maiden Mineral Resource 930koz Gold dated 3 March 2022.

[2] ASX Announcement: Kouri Mineral Resource Increases by 43% to 2 Million ounces Gold dated 26 October 2020 (Total Mineral Resource includes: Indicated Mineral Resource of 7Mt at 1.4g/t gold and Inferred Mineral Resource of 43Mt at 1.2g/t gold).

[3] ASX Announcement: New Resource Estimation for Paguanta dated 30 May 2017 (Total Mineral Resource includes: Measured Mineral Resource of 0.41Mt at 5.5% zinc, 1.8% lead, 88g/t silver, 0.3g/t gold; Indicated Mineral Resource of 0.61Mt at 5.1% zinc, 1.8% lead, 120g/t silver, 0.3g/t gold; Inferred Mineral Resource of 1.3Mt at 4.8% zinc, 1.1% lead, 75g/t silver, 0.3g/t gold).

[4] ASX Announcement: Kada Maiden Mineral Resource 930,000oz Gold dated 3 March 2022. The Inferred Mineral Resource is 25.5Mt at 1.1g/t gold.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()