Worldwide, the U.S. dollar is considered the reserve currency, still. Gold is more promising.

The U.S. dollar accounts for about half of global trade, debt and credit. But the Ukraine war makes one wonder whether the days of the U.S. dollar’s importance are not numbered. Today, about 16 percent of Russia’s foreign exchange reserves are in U.S. dollars. The opinion has often been expressed that the sphere of influence of the U.S. dollar could decline and the currency system as a whole could change in the future. However, currencies are not the only assets held by central banks. Financial reserves for almost all countries also consist of gold. In this context, gold serves as a stabilizer and provides diversification. And gold could mean the real anchor for the world’s monetary system. That’s because gold is backed by central banks. Unlike paper currencies, which always decline in value when new money is printed, the precious metal retains its value. This is because it is a physical commodity and the supply is limited, it cannot be increased at will.

Gold also has no credit or counterparty risk. About one-fifth of all gold ever mined is held by central banks. The most powerful nations, such as the U.S., Germany, France and Italy, hold more than half of their reserves in the form of gold. Russia’s attack could now become the catalyst for a new global monetary system. After all, the economic sanctions against Russia are enormous, and foreign exchange reserves have been frozen without precedent. And the move away from the U.S. dollar is not a new issue. Gold could become a non-currency anchor and also take on an increasingly important role with central banks. For investors it is also advisable to have a few gold shares in the depot. For example, stocks of royalty companies such as Empress Royalty or Gold Royalty are suitable for the purpose of their inherent diversification.

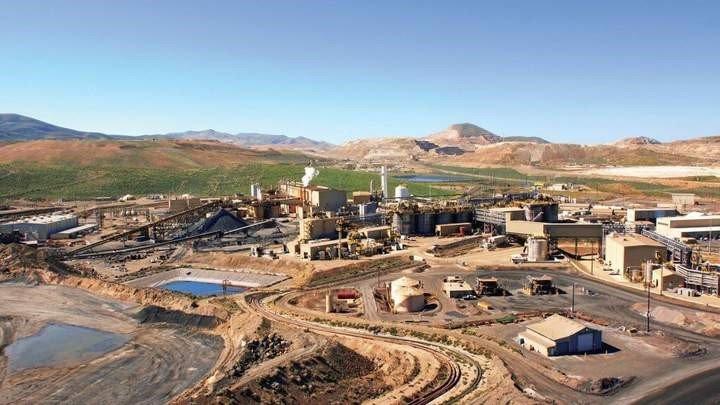

Gold Royalty’s – https://www.youtube.com/watch?v=omgImsRwJX8 – portfolio includes more than 190 royalties in mining-friendly regions in the United States.

Empress Royalty – https://www.youtube.com/watch?v=ObOa2BGw5MM – owns gold and silver investments, from the development stage to the production stage.

Latest corporate information and press releases from Gold Royalty (– https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()