Lucrative investments are not easy to make. Gold has proven itself.

With short-term investments, the risk is greater, but a higher profit is possible. If you are not so risk-averse and prefer to invest for the long term, there is no way around stocks today. And since gold is referred to as the "ultimate currency," why not invest some of your assets in gold stocks. The Russia-Ukraine conflict has given gold appeal. But this conflict also has secondary effects that can give the precious metal a buffer, so to speak, in terms of price. Indeed, macro and financial crises can have a lasting effect on the price of gold. Russia’s isolation causes a shift in the energy sector, which has an inflationary effect. In addition, there is the greater risk of weakening economic growth, especially in Europe. This is because dependence on Russian oil and gas makes Europe vulnerable.

So, the chances for a strong price of the yellow precious metal are very good. Investors who opt for long-term investments could, for example, look at the gold royalty companies. These are broadly positioned and are usually involved in a large number of projects. The mining risk lies with the partner companies, not with the royalty companies. With a royalty company, the investor is involved in various projects, often in exploration and development as well as in already producing projects. Empress Royalty and Gold Royalty are examples of this.

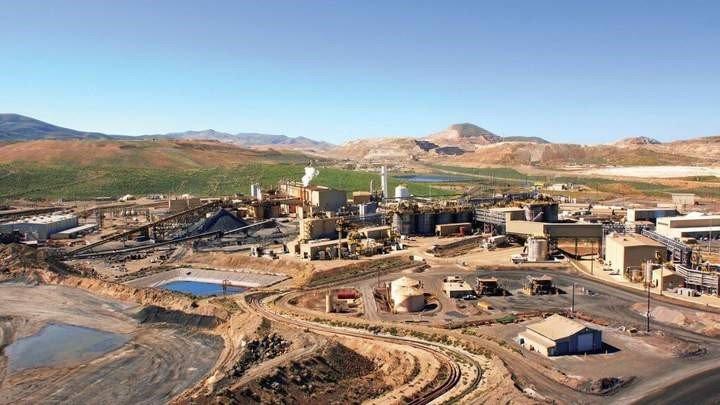

Gold Royalty – https://www.youtube.com/watch?v=6t0hT6NNKCg – has operations in Nevada, Quebec and Ontario.

Empress Royalty – https://www.youtube.com/watch?v=ObOa2BGw5MM – has a portfolio of 17 gold and silver investments from development to production stage.

Latest corporate information and press releases from Gold Royalty (- https://www.resource-capital.ch/en/companies/gold-royalty-corp/ -).

In accordance with §34 WpHG I would like to point out that partners, authors and employees may hold shares in the respective companies addressed and thus a possible conflict of interest exists. No guarantee for the translation into English. Only the German version of this news is valid.

Disclaimer: The information provided does not represent any form of recommendation or advice. Express reference is made to the risks in securities trading. No liability can be accepted for any damage arising from the use of this blog. I would like to point out that shares and especially warrant investments are always associated with risk. The total loss of the invested capital cannot be excluded. All information and sources are carefully researched. However, no guarantee is given for the correctness of all contents. Despite the greatest care, I expressly reserve the right to make errors, especially with regard to figures and prices. The information contained herein is taken from sources believed to be reliable, but in no way claims to be accurate or complete. Due to court decisions, the contents of linked external sites are also co-responsible (e.g. Landgericht Hamburg, in the decision of 12.05.1998 – 312 O 85/98), as long as there is no explicit dissociation from them. Despite careful control of the content, I do not assume liability for the content of linked external pages. The respective operators are exclusively responsible for their content. The disclaimer of Swiss Resource Capital AG also applies: https://www.resource-capital.ch/en/disclaimer/

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

Telefon: +49 (2983) 974041

E-Mail: info@js-research.de

![]()