– 10,000 m Two-Rig Drill Program Beginning At the Hughes Property, Nevada

Summa Silver Corp. (“Summa” or the “Company”) (TSXV:SSVR) (OTCQB:SSVRF) (Frankfurt:48X – https://www.commodity-tv.com/ondemand/companies/profil/summa-silver-corp/) announces high-grade silver and gold drill results from the Mogollon Property near Silver City, New Mexico and the commencement of a significant drill program at the Hughes Property near Tonopah, Nevada. The Company also provides an update on its operations at the Mogollon Property.

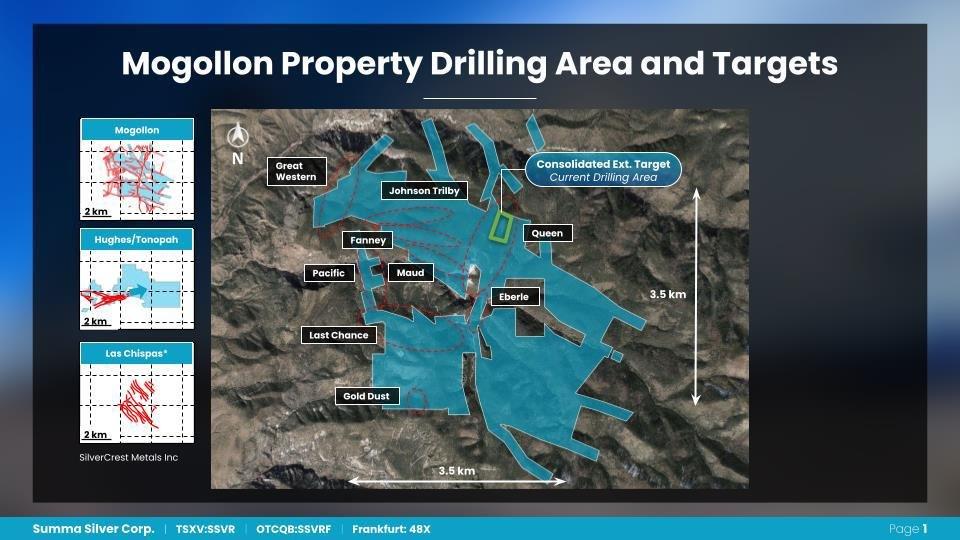

Queen Vein of the past producing Consolidated Mine, Mogollon Property

● 11.6 m at 450 g/t silver equivalent* (2.7 g/t Au, 220 g/t Ag) including 0.9 m at 1,940 g/t silver equivalent (11.35 g/t Au, 975 g/t Ag) in MOG22-04 where total grade thickness through all mineralization is 5,343 g/t AgEq*m (see attached figures).

● 13.6 m at 220 g/t silver equivalent (1.4 g/t Au, 105 g/t Ag) and 4.2 m at 326 g/t silver equivalent (2.23 g/t Au, 137 g/t Ag) plus additional zones in MOG21-01 where total grade thickness through all mineralization is 6,225 g/t AgEq*m.

● 7.1 m at 279 g/t silver equivalent (2.07 g/t Au, 103 g/t Ag) and 8.0 m at 197 g/t silver equivalent (1.32 g/t Au, 85 g/t Ag) plus additional zones in MOG21-02 where total grade thickness through all mineralization is 4,522 g/t AgEq*m.

● Assays Pending: Assay results from holes MOG22-05 and MOG22-06 remain pending. Both holes intersected significant zones of quartz-carbonate veins, stockworks, and breccias commonly featuring visible silver sulfide minerals. This is a strong indication that the core is mineralized (see previously released core photos).

● Open in all Directions: The newly drilled mineralized zone remains open to expansion in all directions.

● Aggressive Drill Plan: The Company anticipates that a minimum of 25,000 m of drilling at Consolidated in 50 holes is necessary for a spacing of approximately 50 m between holes covering an area of approximately 500 x 300 m in order to publish its first resource estimate.

*silver equivalent (AgEq) based on 85(Ag):1(Au) at Mogollon, true widths are unknown.

Galen McNamara, CEO, stated: “It comes as no surprise that results from the first set of holes at Mogollon have confirmed high grade silver mineralization around the old Consolidated Mine. I’d like to emphasize that these are only the first few holes ever drilled by Summa at Mogollon. With over 34 km of identified strike potential, these assays truly prove that Mogollon is as exciting as our Hughes project in Nevada. Summa now has two high-grade silver projects, both of which we believe will prove to be very exciting as we continue to define the extent of the mineralization via aggressive drilling. With the completion of the recent $11.5M financing, we are well funded to execute on that plan and create shareholder value.”

Mogollon Operational Update

Based on the positive results to date, and as a condition of our permit, Summa Silver paused exploration on March 1, 2022 to conduct a survey of the Mexican Spotted Owl, expanding on the initial survey work the company completed in September 2021. The pause in drilling will allow the bird survey to be completed in an uninterrupted manner over approximately 90 days.

The Company is also awaiting assay results from two additional holes which are expected within the next 30 to 60 days. This pause in drilling activity will be used to refine and improve the geological model to maximize the effectiveness of further drilling.

Drilling Commences at the Hughes Property in Nevada to Focus on Step-out and Definition Drilling

● Drilling Started at the Hughes Property: One diamond drill rig is currently in operation with a second rig mobilizing to site.

● Program to Focus on Resource Drilling: The priority targets are the Murray and Belmont areas, where previous drilling intersected strong mineralization. Approximately 10,000 m of drilling is planned at Hughes.

● Strong exploration potential at the Ruby Discovery 1.3 km east of the Belmont Mine:

○ Final two holes from the 2021 drill program at the Ruby Discovery intersected broad zones of strong alteration and classic epithermal style veins on 100 m step-outs from SUM20-10. Core photos of the vein zones in SUM21-49 can be viewed here.

○ SUM21-49 intersected 251 g/t silver equivalent* over 1.9 m including 383 g/t silver equivalent over 0.6 m and SUM21-50 intersected 130 g/t silver equivalent over 0.7 m and 108 g/t silver equivalent over 2.66 m including 186 g/t silver equivalent over 0.6 m

○ The intersection of these zones confirms the strong exploration potential at the Ruby discovery, where large resistivity and chargeability anomalies just east of the area remain undrilled.

*silver equivalent (AgEq) based on 100(Ag):1(Au) at Hughes, true widths are unknown.

Mogollon Drill program

Assay Results

The focus of the Mogollon drill program is testing un-mined extensions of the Consolidated Mine, centered on the north-trending, epithermal-related Queen Vein (see October 15th, 2021 News Release). Holes MOG21-01, 02, 03, and 04 targeted vein-hosted mineralization south of the Consolidated stopes over an area of approximately 100 m by 65 m (Figure 3) where broad zones (up to 50 m) of epithermal-related alteration, veining, and brecciation with locally strong silver-sulfide mineralization were intersected (see February 24th, 2022 News Release).

The first four holes demonstrate the high-grade nature of the Queen Vein and also the strong grade continuity along the vein and within the complex broad vein system. Assay results from drill holes MOG21-01, 02 and MOG22-03 and 04 are reported in Table 1.

● All holes intersected multiple zones of strong silver and gold mineralization. Hole MOG21-01 intersected 326 g/t AgEq over 4.2 m from 295.4 to 299.6 m down hole and 220 g/t AgEq over 13.6 m from 303.7 to 317.3 m down hole for a cumulative grade thickness of 6,225 g/t AgEq*m. Hole MOG21-02 intersected 279 g/t AgEq over 7.1 m from 280.3 to 287.4 m down hole and 197 g/t AgEq over 8.0 m from 299.9 to 307.9 m down hole for a cumulative grade thickness of 4,522 g/t AgEq*m. The presence of multiple parallel zones of vein-hosted mineralization with strong grade continuity attests to the prospectivity of the target.

● Hole MOG22-04 tested the Queen Vein below and to the south of the Consolidated stopes and intersected 450 g/t silver equivalent over 11.6 m from 345 to 356.6 m down hole including 1,940 g/t silver equivalent over 0.9 m from 351.1 to 352 m.

● Hole MOG21-03 was terminated early due to the intersection of historic workings after unexpected and strong deviation of the hole during drilling. The bottom of the hole intersected 185 g/t silver equivalent over 14.0 m from 303.3 to 317.3 m and returned a cumulative grade-thickness of 2,756 g/t AgEq*m which suggests potential for mineralization in the hanging wall to the Consolidated stopes.

Using cumulative grade thickness as a proxy for the tenure of mineralization and also for modelling the presence of plunging high-grade shoots, these holes suggest considerable exploration potential along-strike and down-dip surrounding the Consolidated Mine.

Drill core from holes MOG22-05 and MOG22-06 are currently being processed at site and prepared for shipment.

The Queen Vein system consists of a hanging wall of silicified and brecciated andesite and rhyolite cut by zones of colloform-banded chalcedonic quartz veins increasing in frequency with depth towards the Queen Vein. The Queen Vein is highly-complex with evidence for multiple epithermal-related fluid events that formed calcite + quartz veins, quartz-rich breccias with bladed quartz, colloform banding, and local silver-bearing sulfides. The footwall to the Queen Vein system consists of intensely silicified and brecciated andesite with locally abundant silver-bearing sulfides as disseminations and banded within chalcedony-rich veins. Drill holes on 50 to 100 m centers are designed to systematically test the lateral and vertical continuity of mineralization over a strike-length of approximately 500 m and near-vertical, down-dip extent of over 300 m beginning at approximately 130 m below surface.

Hughes Drill Program

Current Phase

Drilling will first focus on the Murray vein, on the western side of the Hughes Property where the gently-dipping, southwest-striking vein is associated with broad intervals of strong argillic alteration cored by zones of quartz-stockwork up to 30 m wide with local Ag-sulfide bearing, banded quartz veins. Previous drilling by Summa (e.g., 4,116 AgEq over 0.4 m and 303 g/t AgEq over 4.1 m in SUM21-037; see December 8th, 2021 News Release) defined strong grade continuity over an area of approximately 300 by 200 m where it remains open for expansion. Infill and exploration drilling up- and down-dip along the vein will be the focus for this phase of drilling. Holes are currently planned on 50 to 100 m centers.

Final results from previous phase

Assay results from the final two holes drilled at Hughes in late 2021 have been returned from the lab. Holes SUM21-49 and 50 tested the lateral and vertical extent on 100 m step-outs of epithermal-related silver and gold mineralization discovered in 2020 at the Ruby target (SUM20-10). Both holes intersected broad zones of silica + clay alteration and local quartz-adularia breccias featuring visible Ag-sulfides. The Ruby Discovery is approximately 1.3 kilometers east of the Belmont Mine and may represent the eastern extent of the prolific historic Tonopah Mining district. Hole SUM21-49 intersected 251 g/t silver equivalent over 1.9 m including 383 g/t silver equivalent over 0.6 m and hole SUM21-50 intersected 130 g/t silver equivalent over 0.7m and 108 g/t silver equivalent over 2.7 m including 186 g/t silver equivalent over 0.6 m. Data from all holes at Ruby are being modeled to inform the structural setting of the hydrothermal system and to develop new vectors to high-grade zones.

The broad zones of strong hydrothermal alteration and local vein- and breccia-hosted mineralization are spatially associated with the shoulder of a large and untested coincident high-chargeability and high-resistivity anomaly (Figure 5). This anomaly, centered 500 m east of the Ruby Discovery, is interpreted to be structurally controlled silica alteration zones host to possible sulfide mineralization. Additional step-out drilling to the east of Ruby towards the core of the geophysical anomaly is warranted.

Analytical and QA/QC Procedures

Drill core was sawn in half at Summa’s core logging and processing facilities at the Mogollon and Hughes properties. Samples from both properties were sent to Paragon Geochemical Laboratories in Sparks, Nevada for preparation and analysis. Paragon meets all requirements of the International Accreditation Service AC89 and demonstrates compliance with ISO/IEC Standard 17025:2017 for analytical procedures. Samples were analyzed for gold via fire assay with an AA finish (“Au-AA30”) and silver via atomic emission spectroscopy after four-acid digestion (“AgMA-AAS”). Samples that assayed over 8 ppm Au were re-run via fire assay with a gravimetric finish (“Au-GR30”). Samples that assayed over 100 ppm Ag were re-run via fire assay for Ag with a gravimetric finish (“Ag-GRAA30”). In addition to ALS quality assurance / quality control (“QA/QC”) protocols, Summa Silver implements an internal QA/QC program that includes the insertion of sample blanks, duplicates, and certified reference materials at systematic and random points in the sample stream.

Qualified Person

The technical content of this news release has been reviewed and approved by Galen McNamara, P. Geo., the CEO of the Company and a qualified person as defined by National Instrument 43-101.

About Summa Silver Corp

Summa Silver Corp is a Canadian junior mineral exploration company. The Company owns a 100% interest in the Hughes property located in central Nevada and has an option to earn 100% interest in the Mogollon property located in southwestern New Mexico. The Hughes property is host to the high-grade past-producing Belmont Mine, one of the most prolific silver producers in the United States between 1903 and 1929. The Mogollon property is the largest historic silver producer in New Mexico. Both properties have remained inactive since commercial production ceased and neither have seen modern exploration prior to the Company’s involvement.

Follow Summa Silver on Twitter: @summasilver

LinkedIn: https://www.linkedin.com/company/summa-silver-corp/

ON BEHALF OF THE BOARD OF DIRECTORS

“Galen McNamara”

Galen McNamara, Chief Executive Officer

info@summasilver.com

www.summasilver.com

Investor Relations Contact:

Kin Communications

Giordy Belfiore

604-684-6730

SSVR@kincommunications.com

In Europe:

Swiss Resource Capital AG

Jochen Staiger

info@resource-capital.ch

www.resource-capital.ch

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary note regarding forward-looking statements

This news release contains certain “forward looking statements” and certain “forward-looking information” as defined under applicable Canadian and U.S. securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as “may”, “will”, “should”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “continue”, “plans” or similar terminology. The forward-looking information contained herein is provided for the purpose of assisting readers in understanding management’s current expectations and plans relating to the future. These forward‐looking statements or information relate to, among other things: the release of assays; the exploration and development of the Company’s mineral exploration projects including completion of surveys and drilling activities; and the completion of the Mexican Spotted Owl Survey.

Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual actions, events or results to be materially different from those expressed or implied by such forward-looking information, including but not limited to: the requirement for regulatory approvals; enhanced uncertainty in global financial markets as a result of the current COVID-19 pandemic; unquantifiable risks related to government actions and interventions; stock market volatility; regulatory restrictions; and other related risks and uncertainties.

Forward-looking information are based on management of the parties’ reasonable assumptions, estimates, expectations, analyses and opinions, which are based on such management’s experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect.

The Company undertakes no obligation to update forward-looking information except as required by applicable law. Such forward-looking information represents management’s best judgment based on information currently available. No forward-looking statement can be guaranteed and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements or information.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()