Highlights:

- Second locked cycle test confirms recovery gains, improved concentrate quality from latest flowsheet improvements

- Total nickel recovery of 63% from low nickel feed grade of 0.19% nickel

- Nickel sulphide concentrate grade of 46% nickel, believed to be highest grade nickel sulphide concentrate produced in locked cycle test based on published studies

Canada Nickel Company Inc. ("Canada Nickel" or the "Company") (TSXV:CNC) (OTCQX:CNIKF – https://www.commodity-tv.com/ondemand/companies/profil/canada-nickel-company-inc/ ) today announced further metallurgical results at its 100% owned Crawford Nickel Sulphide Project which delivered what the Company believes is the highest nickel sulphide concentrate grade from a locked cycle test.

The test results also confirm the newest flowsheet improvements, incorporated as part of metallurgical variability testing for the feasibility study, can deliver improved recoveries and improved concentrate quality.

Mark Selby, Chair and CEO said, “I am very pleased with the first two tests achieving nickel recoveries in excess of 60%. This latest test is further confirmation of both significant recovery and excellent nickel sulphide concentrate grades particularly from a low-grade sample. Results from this latest phase of testing are indicating that we can achieve grades of 40-50% for the high grade nickel concentrate, well above the current 35% target for this product. While we will test a broad range of samples during the upcoming phase of feasibility study work and expect a range of recovery results from 30% to 60+%, this second locked cycle test further demonstrates the potential to deliver improvements in nickel recovery substantially higher than the 4-5 percentage point improvement in nickel recovery the Company is targeting for the feasibility study. Each percentage point of improvement in nickel recovery would yield a US$92 million improvement in the value of the NPV8% of the project, based on the Preliminary Economic Analysis (“PEA”) metrics.”

Mr. Selby continued, “Additionally, the Company has continued to make further additions to its land holdings in the Timmins district and continues to make good progress with the strategic investor process for which the process is expected to be successfully concluded during the first quarter.. The Company has also set its date for its annual general meeting.”

Flowsheet Development program

A key focus of the feasibility study activities is the continued improvement in flowsheet performance given its potential to add significant value to the project, particularly as less than one year of work had been completed on the project before results of the PEA were announced on May 25, 2021. Since releasing the PEA, two phases of optimization work have been completed: Phase 1 focused on increasing recoveries, while Phase 2 has focused on increasing concentrate quality at increased recovery. The conditions and flowsheet used in this test reflect optimizations for both concentrate quality and recovery.

This locked cycle test (“LCT”) used the optimized flowsheet which the company expects to take forward into the next phase of metallurgical testing for the feasibility study. The test was conducted at XPS Expert Process Solutions, a Glencore Company (“XPS”), and was the second LCT completed since releasing the PEA. The LCT was completed to measure the impact of flowsheet improvements made over the past eight months. The sample selected for testing was a lower grade heazlewoodite (Ni3S2) dominant sample which also contained small amounts of awaruite (Ni3Fe). The head grades for the sample were 0.19% nickel, 0.07% sulphur, and 7.7% iron. This sample was selected to test the robustness of the current flowsheet on a lower grade sample from the deposit.

The flowsheet utilized in this test included changes to reagents, grind sizes, and position of magnetic separation in the flowsheet. No further details are being provided at this time as the Company believes these improvements are a proprietary competitive advantage.

As expected, 100% of the nickel recovery in the flotation concentrate reported to the High Grade Concentrate product because heazlewoodite and awaruite were the primary minerals in this sample. The nickel concentrate grade of 46% is 11 percentage points higher than our target 35% grade for this product. The iron and MgO content of the flotation concentrate was 7.3% and 13% respectively. PGM assays are pending for this test.

As anticipated, the cobalt recovery for this sample was low because cobalt does not typically associate with the minerals heazlewoodite and awaruite.

The results of the previous released locked cycle test were reported in the news release dated October 5, 2021.

The magnetite concentrate from the current test had an iron grade of 51%, which is a substantial improvement over the modelled grade of the 47.5% iron utilized in the PEA. The chromium grade of 1.2% is lower than the 3.3% chromium grade that was modelled in the PEA and the chromium recovery of 17% was lower than target recovery in the PEA of 27%. Of the total nickel recovery of 63%, 7 percentage points of the total recovery reported to the magnetite concentrate. Given the nickel and chromium content of this magnetite concentrate, it is expected to be utilized in the production of stainless steel and other alloys where the nickel and chromium are a valuable feed.

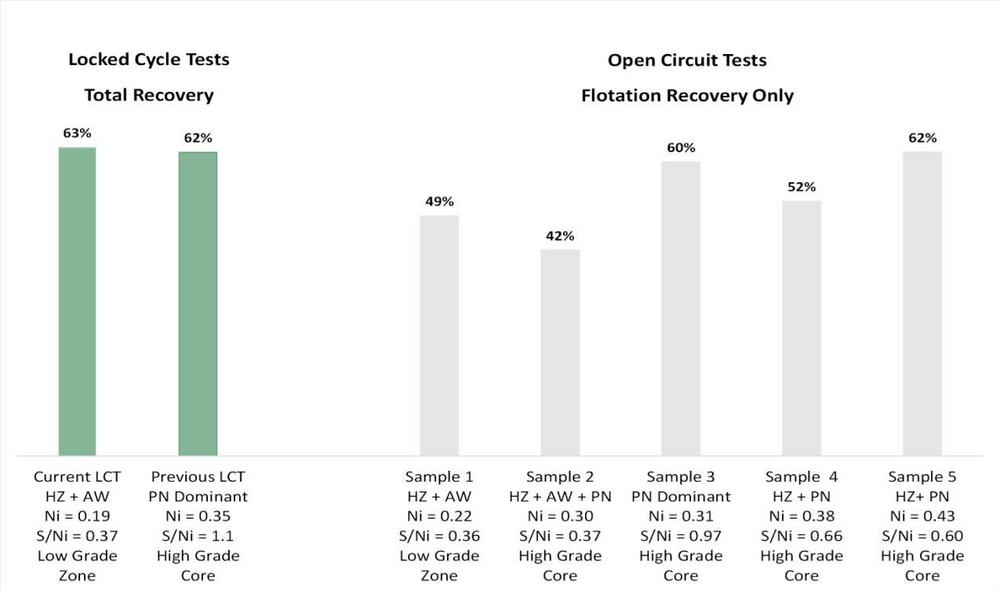

Figure 1 summarizes the recovery results for the two locked cycle tests as well as five open circuit tests which were completed with various phases of flowsheet improvements since the PEA.

The open circuit test recovery results, which ranged from 42% to 62% on samples with nickel head grades between 0.22% to 0.43% nickel do not include any recovery of nickel to the magnetite concentrate.

Sample Location

This sample was taken from drill hole CR21-175 from the North Low Grade Zone of the Crawford East Zone.

Next Steps in Flowsheet Development

Metallurgical test work through the remainder of 2022 will focus on finalizing and evaluating a flowsheet for the Feasibility Study which is expected to be completed by the fourth quarter of 2022.

Nickel recovery from the slimes circuit was not included in the reported results and represents a further opportunity to improve flowsheet performance and will be evaluated during this phase of feasibility work.

For further details, including key assumptions, parameters and methods used to estimate the results of the PEA, and data verification, please refer the "Crawford Nickel-Sulphide Project National Instrument 43-101 Technical Report and Preliminary Economic Assessment", with an Effective Date of May 21, 2021, as filed July 12, 2021, and available for viewing on the Company’s website www.canadanickel.com.

Corporate Update

The Company is announcing that its annual general meeting of shareholders ("AGM") will be held on Wednesday, April 20, 2022. As a result of the ongoing impact of the COVID-19 pandemic and in accordance with continued public health measures, the Company will host its AGM in a virtual-only format.

Holders of record of common shares of the Company as of the close of business on March 11, 2022 will be entitled to receive notice of and vote at the AGM. Detailed instructions for shareholders about how to participate in the AGM and how to duly appoint a proxyholder, will be provided to shareholders in a notice of meeting in advance of the AGM.

Purchase or Option of Timmins-Area Properties

The Company is also pleased to announce that it has entered into four purchase or option agreements covering certain properties located in the Timmins, Ontario nickel-sulphide mining district. Under these agreements, Canada Nickel has agreed to issue the shares and pay the cash listed in the table below, and has agreed that each of the sellers will retain a net smelter royalty (“NSR”) that ranges between 1% and 2%, with Canada Nickel having the right to re-purchase 50% of the royalty for $500,000 (with respect to a 1% NSR) or $1 million (with respect to a 2% NSR).

Canada Nickel also wishes to clarify, further to its November 22, 2021 news release announcing a series of property acquisitions (the "Prior Release"), that it previously entered into a purchase agreement to acquire certain mining claims located in additional townships in the Timmins, Ontario nickel-sulphide mining district, which was not specifically disclosed in the Prior Release. Under this agreement, Canada Nickel issued shares and paid cash as disclosed in the Prior Release. No NSR was retained by the vendor.

Canada Nickel also wishes to clarify, with respect to one of the agreements disclosed in the Prior Release, that (i) the consideration payable to the applicable vendor on closing was 110,000 shares, rather than the 115,000 shares that is reflected in the table of aggregate consideration (Table 10) which is included in the Prior Release, and (ii) up to an additional $15,000 and 25,000 shares may be provided to such vendor if certain royalty targets are met.

The common shares described in this news release are subject to a four-month hold period from the date of their respective issuances. Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Qualified Person and Data Verification

Arthur G. Stokreef, P.Eng (ON), Manager of Process Engineering & Geometallurgy and a “qualified person” as such term is defined by National Instrument 43-101, has reviewed and approved the technical information in this news release on behalf of Canada Nickel Company Inc.

About Canada Nickel

Canada Nickel Company Inc. is advancing the next generation of nickel-sulphide projects to deliver nickel required to feed the high growth electric vehicle and stainless steel markets. Canada Nickel Company has applied in multiple jurisdictions to trademark the terms NetZero Nickel™, NetZero Cobalt™ and NetZero Iron™ and is pursuing the development of processes to allow the production of net zero carbon nickel, cobalt, and iron products. Canada Nickel provides investors with leverage to nickel in low political risk jurisdictions. Canada Nickel is currently anchored by its 100% owned flagship Crawford Nickel-Cobalt Sulphide Project in the heart of the prolific Timmins-Cochrane mining camp. For more information, please visit www.canadanickel.com.

Cautionary Statement Concerning Forward Looking Statements

This press release contains certain information that may constitute "forward-looking information" under applicable Canadian securities legislation. Forward looking information includes, but is not limited to, the metallurgical results, the timing and results of the feasibility study, the results of Crawford’s PEA, including statements relating to net present value, future production, estimates of cash cost, proposed mining plans and methods, mine life estimates, cash flow forecasts, metal recoveries, estimates of capital and operating costs, timing for permitting and environmental assessments, realization of mineral resource estimates, capital and operating cost estimates, project and life of mine estimates, ability to obtain permitting by the time targeted, size and ranking of project upon achieving production, economic return estimates, the timing and amount of estimated future production and capital, operating and exploration expenditures and potential upside and alternatives. Readers should not place undue reliance on forward-looking statements.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Canada Nickel to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. The PEA results are estimates only and are based on a number of assumptions, any of which, if incorrect, could materially change the projected outcome. There are no assurances that Crawford will be placed into production. Factors that could affect the outcome include, among others: the actual results of development activities; project delays; inability to raise the funds necessary to complete development; general business, economic, competitive, political and social uncertainties; future prices of metals or project costs could differ substantially and make any commercialization uneconomic; availability of alternative nickel sources or substitutes; actual nickel recovery; conclusions of economic evaluations; changes in project parameters as plans continue to be refined; accidents, labour disputes, the availability and productivity of skilled labour and other risks of the mining industry; political instability, terrorism, insurrection or war; delays in obtaining governmental approvals, necessary permitting or in the completion of development or construction activities; mineral resource estimates relating to Crawford could prove to be inaccurate for any reason whatsoever; additional but currently unforeseen work may be required to advance to the feasibility stage; and even if Crawford goes into production, there is no assurance that operations will be profitable.

Although Canada Nickel has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Forward-looking statements contained herein are made as of the date of this news release and Canada Nickel disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or results or otherwise, except as required by applicable securities laws.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()