No surprises, all new car registrations are down.

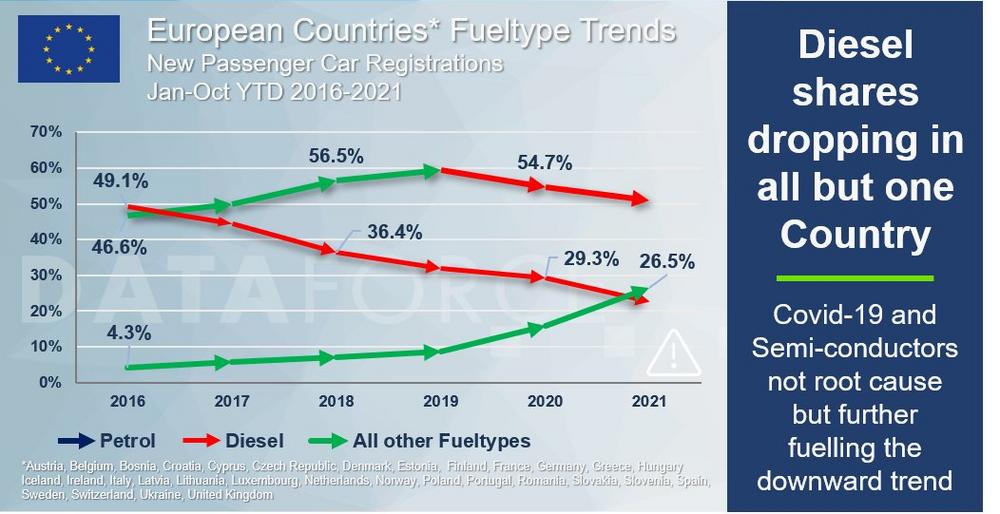

Sure, all fuels are down at present thanks to semi-conductor shortages and pandemic influences, but the outlook sees an easing of this in 2022 as the shortages begin to ease. Looking at 2021 vs 2019 YTD October Passenger Cars registrations for 31 European countries we can see that the overall market is down by around 3.3 million or 25%, though worth noting is that this up by almost 300,000 over 2020. For Diesel this is slightly grimmer, down by 47% or just over 2million registrations, the oil burning engines make up almost 60% of all the losses for 2021 vs 2019 YTD October.

As semi-conductors become more freely available Diesel registrations should increase marginally over 2021 figures though this will likely be short-lived and once again contract from 2023 and beyond.

If we investigate the 21 countries where we have the True Fleet figures available, the story is slightly better but not by much. Down by 43% or around 720,000 vehicles as of Oct YTD 2021 vs 2019, with the EU7 countries accounting for over 600,000 of those missing registrations.

The story is not (as accentuated) the same everywhere

We can certainly see there are certain markets not feeling the pinch as much as others and even one nation that has grown its Diesel registrations, though we must move into the east of Europe to find these. Once again looking at Passenger Cars Oct YTD 2021 vs 2019, this time for all Commercial market segments, it is Ukraine bucking the trend having increase its registrations by 13% to a little over 10,000 so far. Estonia is marginally negative with a 0.1% loss for Diesel. The other nations, where more volume on a whole is registered, still showed the contractions and while larger are certainly not as heavy as most western nations have seen. Hungary is down 11% Bosnia is 23%, Czech Republic is 25% and both Slovakia and Poland have shrunk by 29%.

How this is going to affect the used car market, once we are back to an almost normal New Car registration volume is something to watch for. Add to this the incentives for EVs and maluses for full ICEs in an ever-increasing number of countries the pressure continues to build against Diesel.

Dataforce is the leading provider of fleet market data and automotive intelligence solutions in Europe.

In addition, the company also provides detailed information on sales opportunities for the automotive industry, together with a wide portfolio of information based on primary market research and consulting services. The company is based in Frankfurt, Germany.

Dataforce Verlagsgesellschaft für Business Informationen mbH

Hamburger Allee 14

60486 Frankfurt am Main

Telefon: +49 (69) 95930-0

Telefax: +49 (69) 95930-333

http://www.dataforce.de

Telefon: +49 (69) 95930-253

Fax: +49 (69) 95930-333

E-Mail: richard.worrow@dataforce.de

![]()