- In H1 2021, Lonza continued its strong performance with 14.7%1 sales growth and 33.3% CORE EBITDA margin, despite headwinds arising from COVID-19

- Continued focus on growth CAPEX investments, supported by strong business pipeline

- Expanded collaborations to support COVID-19 programs including Moderna

- Divestment of Specialty Ingredients business completed on 1 July 2021

- Path forward for a sustainable remediation project agreed for Gamsenried (CH) legacy landfill site will allow Lonza to proceed with its ambitious sustainability agenda

- 2021 Outlook: CER sales growth guidance revised upwards to mid-teens. CORE EBITDA margin improvement in line with Mid-Term Guidance trajectory

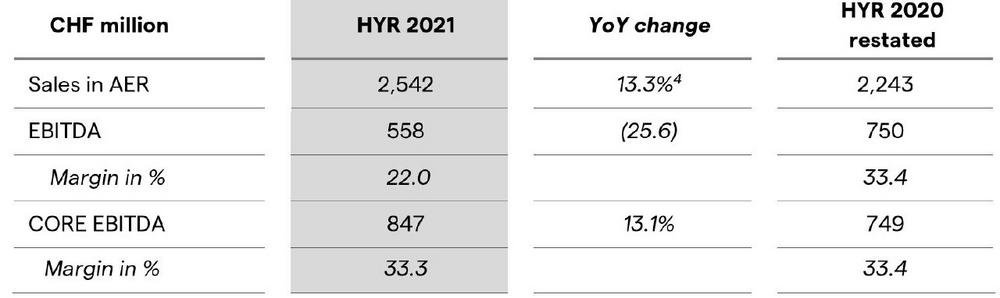

Lonza today reported sales of CHF 2.5 billion, sales growth of 14.7%1 and CHF 847 million CORE EBITDA, resulting in a margin of 33.3%. This strong momentum has been delivered despite the headwinds arising from the COVID-19 pandemic, including impacts to the ramp-up of new assets and the wider manufacturing schedule. Despite these challenges, Lonza has achieved its commitment to deliver for customers throughout the pandemic by expanding production and increasing headcount.

Lonza has seen continued customer demand for COVID-related projects during H1 2021, including the expansion of its collaboration with Moderna for the drug substance production of Moderna’s COVID-19 vaccine at Lonza Visp (CH) and Lonza Geleen (NL).

Throughout H1 2021, Lonza has placed a strategic focus on expanding end-to-end solutions across modalities, which is reflected in the incremental investments announced. In H1, Lonza has invested a total of CHF 474 million CAPEX. Investments supporting growth contributed to around 80% of the total amount. Lonza anticipates that the current levels of CAPEX spending on internal growth initiatives will continue to increase over the course of H2. Total CAPEX for Full-Year is anticipated to reach around 25% of sales.

The company’s growth plans are supported by the additional free cash flows arising from the Specialty Ingredients divestment, which was completed on 1 July 2021. The majority of proceeds will be invested in internal growth projects over the course of 2021 and beyond. Lonza is also considering acquisitions in key strategic areas and new technologies.

As Lonza continues to prioritize sustainability, the company has been working closely with the cantonal authorities of Valais (CH) to find a lasting solution to the groundwater pollution issues caused by its old Gamsenried (CH) landfill. A path forward has been agreed to provide a permanent solution to these legacy pollution issues, in compliance with the current environmental protection legislation. In line with IFRS requirements, Lonza has made a provision of CHF 290 million for the first phase of the Gamsenried remediation project. The company has worked with its environmental experts to reach a reasonable cost estimate, and it believes this provision should cover the majority of total remediation costs.

Lonza confirms an upward revision to its 2021 Outlook, reflecting the expectation to achieve mid-teens CER sales growth. The company also anticipates a CORE EBITDA margin improvement in line with the Mid-Term Guidance trajectory, as guided at the beginning of the year. The 2021 Outlook assumes a similar level of COVID-related impacts, no significant adverse impact on demand and no further disruptions in supply chain or business operations.

Pierre-Alain Ruffieux, CEO, Lonza commented: “We are pleased to have maintained a strong performance in H1 2021, despite the headwinds arising from the on-going COVID-19 pandemic. These results are a testament to the remarkable commitment and determination of our global employee community.

“The First Half of 2021 has been a time of dynamic evolution as we completed the divestment of our former Specialty Ingredients business, while continuing to accelerate our internal growth plans. We have also made significant progress in addressing the legacy issue at our Gamsenried (CH) landfill site, which will allow us to progress our ambitious sustainability agenda in the years to come.

“We are pleased to confirm an upward revision to our anticipated sales growth in our 2021 Outlook as we continue to accelerate our growth momentum.”

Divisional Overview

- Small Molecules saw new growth projects approved and a sustained level of customer demand. The business achieved a 16.5%1 increase in sales growth compared to H1 2020, alongside an improved CORE EBITDA margin of 27.3%.

- Biologics benefited from strong customer demand and new contracts across technologies and scales. The business was able to meet these high levels of demand by actively managing the supply impacts arising from the pandemic. Compared to H1 2020, Biologics saw strong sales growth of 16.7%2, accompanied by a CORE EBITDA margin decrease to 38.2%.

- Cell & Gene delivered 24.7%2 sales growth and an improved margin of 16.1% compared to H1 2020.

– Cell & Gene Technologies saw performance driven by the further growth of its customer pipeline and a focus on continuous operational improvement. The business aims to approach a break-even margin by Q4 2021.

– Bioscience achieved positive sales momentum, driven by Discovery and Testing as well as solid demand for equipment and software.

- Capsules & Health Ingredients delivered a strong performance with particularly high demand for capsules. Compared to H1 2020, the business saw a CORE EBITDA margin decrease to 35.4%. This has been accompanied by 5.8%2 sales growth.

For more detail on performance and financials, please refer to the Half-Year 2021 Presentation, Half-Year 2021 Report and Alternative Performance Measures (APM) 2021 Report.

1Sales growth figures, expressed as a percentage (%), are at constant exchange rate (CER)

2Sales growth figures, expressed as a percentage (%), are at constant exchange rate (CER)

3All financial information referring to “continuing operations” are exclusive of the Specialty Ingredients business, that was sold on 1 July 2021 and therefore reported as discontinued operations

4Actual exchange rate (AER); in constant exchange rate (CER): +14.7%

Additional Information and Disclaimer

Lonza Group Ltd has its headquarters in Basel, Switzerland, and is listed on the SIX Swiss Exchange. It has a secondary listing on the Singapore Exchange Securities Trading Limited (“SGX-ST”). Lonza Group Ltd is not subject to the SGX-ST’s continuing listing requirements but remains subject to Rules 217 and 751 of the SGX-ST Listing Manual.

Certain matters discussed in this news release may constitute forward-looking statements. These statements are based on current expectations and estimates of Lonza Group Ltd, although Lonza Group Ltd can give no assurance that these expectations and estimates will be achieved. Investors are cautioned that all forward-looking statements involve risks and uncertainty and are qualified in their entirety. The actual results may differ materially in the future from the forward-looking statements included in this news release due to various factors. Furthermore, except as otherwise required by law, Lonza Group Ltd disclaims any intention or obligation to update the statements contained in this news release.

Lonza is the preferred global partner to the pharmaceutical, biotech and nutrition markets. We work to enable a healthier world by supporting our customers to deliver new and innovative medicines that help treat a wide range of diseases. We achieve this by combining technological insight with world-class manufacturing, scientific expertise and process excellence. Our unparalleled breadth of offerings enables our customers to commercialize their discoveries and innovations in the healthcare sector.

Founded in 1897 in the Swiss Alps, today, Lonza operates across five continents. With approximately 15,000 full-time employees, we comprise high-performing teams and individual talent that make a meaningful difference to our own business, as well as to the communities in which we operate. The company generated sales of CHF 2.5 billion with a CORE EBITDA of CHF 847 million in H1 2021. Find out more at [url=http://www.lonza.com]www.lonza.com[/url]

Lonza Group Ltd.

Münchensteinerstraße 38

CH4002 Basel

Telefon: +41 (61) 3168638

Telefax: +41 (61) 3169638

http://www.lonza.com

Head of Corporate Communications

Telefon: +41 (79) 599-6260

E-Mail: victoria.morgan@lonza.com

Telefon: +41 (61) 316-8540

Fax: +41 (61) 316-9540

E-Mail: dirk.oehlers@lonza.com

![]()