Eskay Creek Phase I Infill Drilling – Highlights:

- 96 g/t Au, 39 g/t Ag (4.48 g/t AuEq) over 28.50 m (SK-20-310)

- 27 g/t Au, 2,185 g/t Ag (54.40 g/t AuEq) over 3.00 m (SK-20-319)

- 06 g/t Au, 576 g/t Ag (10.74 g/t AuEq) over 9.00 m (SK-20-365)

- 82 g/t Au, 172 g/t Ag (10.11 g/t AuEq) over 12.00 m (SK-20-370)

- 27 g/t Au, 26 g/t Ag (5.62 g/t AuEq) over 22.07 m (SK-20-371)

Gold Equivalent (AuEq) calculated via the formula: Au (g/t) + [Ag (g/t) / 75]. True widths range from 70-100% of reported core lengths. Length weighted AuEq composites are constrained by geological considerations. Grade-capping of individual assays has not been applied to the Au and Ag assays informing the length-weighted AuEq composites. Metallurgical processing recoveries have not been applied to the AuEq calculation and are taken at 100%. Samples below detection limit were nulled to a value of zero.

Phase I Infill Drilling Confirms Modelled Mineralization

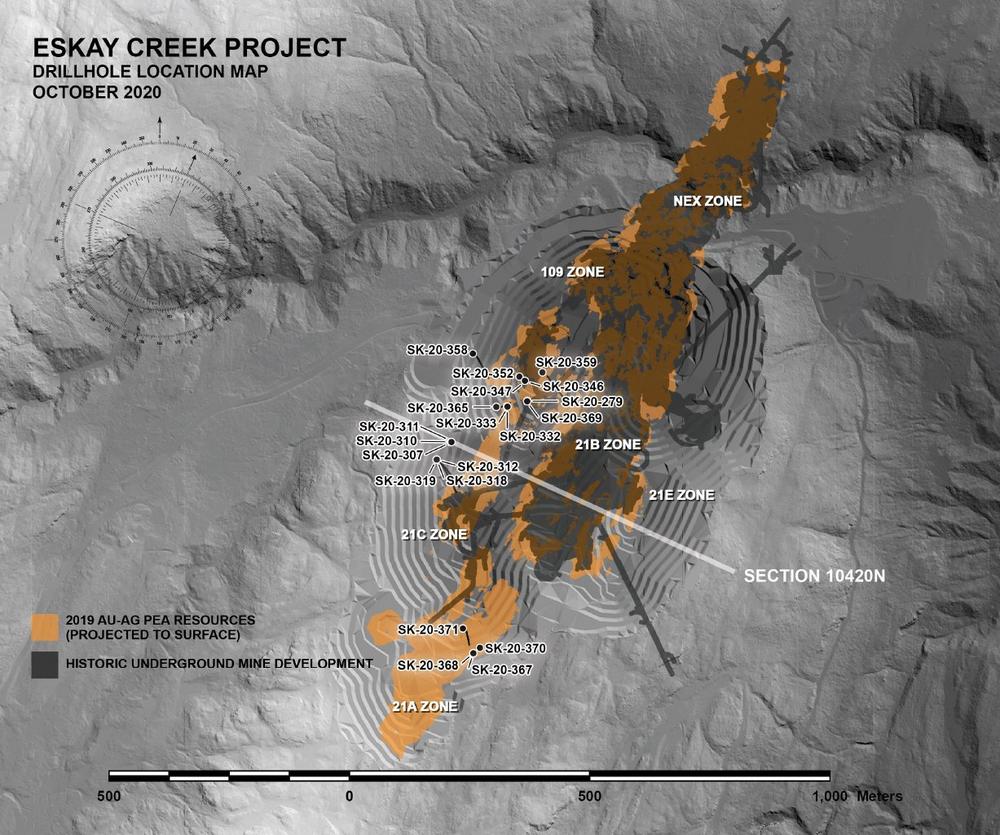

The recently completed Phase 1 portion of the infill drilling campaign at Eskay Creek confirms the predictability of the Company’s 2019 Mineral Resource Estimate (“MRE”), which was largely informed by historical drilling results. As well, recent drill intercepts of grades and widths in the 21C Zone continue to correlate very well with the modelled Inferred mineralization (see section 10420 below).

Precious metal tenor in the 21C Zone has been upgraded from previous Phase I drill holes as demonstrated by recently completed drill hole SK-20-310 which intersected 3.96 g/t Au, 39 g/t Ag (4.48 g/t AuEq) over 28.50 m. Previously reported flanking drill holes SK-20-302 and SK-20-362 intersected 1.99 g/t AuEq over 49.16 m and 2.06 g/t AuEq over 37.00 m respectively and are situated on section less than 15 m from SK-20-310.

Exploration Update

The Company is now drilling the Phase 2 program with a total of nine helicopter supported drill rigs. 46,700 m have been drilled since the Company re-started drilling at Eskay Creek this past July. An additional two rigs are due to be on site in the coming weeks to facilitate the completion of the remaining 43,000 m to be drilled by the end of December 2020. Turnaround time for sample analysis is currently greater than 25 days and the company is awaiting analytical results for 16,900 m over 132 drill holes.

Exploration drilling at the Company’s Snip gold project (“Snip”) will commence on October 29 with one helicopter-supported drill rig. Resource expansion drilling at Snip is budgeted at 5,000 m.

About Skeena

Skeena Resources Limited is a junior mining company focused on developing the past-producing Eskay Creek gold-silver mine located in Tahltan Territory in the Golden Triangle of northwest British Columbia, Canada. The Company released a robust Preliminary Economic Assessment in late 2019 and is currently focused on infill and exploration drilling at Eskay Creek to advance the project to Prefeasibility. Skeena is also exploring the past-producing Snip gold mine.

On behalf of the Board of Directors of Skeena Resources Limited,

Walter Coles Jr.

President & CEO

Qualified Persons

Exploration activities at the Eskay Creek Project are administered on site by the Company’s Exploration Managers, Colin Russell, P.Geo. and Adrian Newton, P.Geo. In accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects, Paul Geddes, P.Geo. Vice President Exploration and Resource Development, is the Qualified Person for the Company and has prepared, validated and approved the technical and scientific content of this news release. The Company strictly adheres to CIM Best Practices Guidelines in conducting, documenting, and reporting the exploration activities on its projects.

Quality Assurance – Quality Control

Once received from the drill and processed, all drill core samples are sawn in half, labelled and bagged. The remaining drill core is subsequently securely stored on site. Numbered security tags are applied to lab shipments for chain of custody requirements. The Company inserts quality control (QC) samples at regular intervals in the sample stream, including blanks and reference materials with all sample shipments to monitor laboratory performance. The QAQC program was designed and approved by Lynda Bloom, P.Geo. of Analytical Solutions Ltd., and is overseen by the Company’s Qualified Person, Paul Geddes, P.Geo, Vice President Exploration and Resource Development.

Drill core samples are submitted to ALS Geochemistry’s analytical facility in North Vancouver, British Columbia for preparation and analysis. The ALS facility is accredited to the ISO/IEC 17025 standard for gold assays and all analytical methods include quality control materials at set frequencies with established data acceptance criteria. The entire sample is crushed and 1 kg is pulverized. Analysis for gold is by 50 g fire assay fusion with atomic absorption (AAS) finish with a lower limit of 0.01 ppm and upper limit of 100 ppm. Samples with gold assays greater than 100 ppm are re-analyzed using a 50 g fire assay fusion with gravimetric finish. Analysis for silver is by 50 g fire assay fusion with gravimetric finish with a lower limit of 5ppm and upper limit of 10,000 ppm. Samples with silver assays greater than 10,000 ppm are re-analyzed using a gravimetric silver concentrate method. A selected number of samples are also analyzed using a 48 multi-element geochemical package by a 4-acid digestion, followed by Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) and Inductively Coupled Plasma Mass Spectroscopy (ICP-MS) and also for mercury using an aqua regia digest with Inductively Coupled Plasma Atomic Emission Spectroscopy (ICP-AES) finish. Samples with sulfur reporting greater than 10% from the multi-element analysis are re-analyzed for total sulfur by Leco furnace and infrared spectroscopy.

Cautionary note regarding forward-looking statements

Certain statements made and information contained herein may constitute “forward looking information” and “forward looking statements” within the meaning of applicable Canadian and United States securities legislation. These statements and information are based on facts currently available to the Company and there is no assurance that actual results will meet management’s expectations. Forward-looking statements and information may be identified by such terms as “anticipates”, “believes”, “targets”, “estimates”, “plans”, “expects”, “may”, “will”, “could” or “would”. Forward-looking statements and information contained herein are based on certain factors and assumptions regarding, among other things, the estimation of mineral resources and reserves, the realization of resource and reserve estimates, metal prices, taxation, the estimation, timing and amount of future exploration and development, capital and operating costs, the availability of financing, the receipt of regulatory approvals, environmental risks, title disputes and other matters. While the Company considers its assumptions to be reasonable as of the date hereof, forward-looking statements and information are not guarantees of future performance and readers should not place undue importance on such statements as actual events and results may differ materially from those described herein. The Company does not undertake to update any forward-looking statements or information except as may be required by applicable securities laws.

Neither the Toronto Stock Exchange nor the Investment Industry Regulatory Organization of Canada accepts responsibility for the adequacy or accuracy of this release.

Swiss Resource Capital AG

Poststrasse 1

CH9100 Herisau

Telefon: +41 (71) 354-8501

Telefax: +41 (71) 560-4271

http://www.resource-capital.ch

CEO

Telefon: +41 (71) 3548501

E-Mail: js@resource-capital.ch

![]()